Quantum Force Theory, Spin & the RES ⇔ Equation

Quantum Force Theory, Spin & the RES ⇔ Equation

Quantum Force Theory

Had it not been for the tangible results and profit centres created by the RES equation, its unlikely Quantum Force Theory would have received a mention, as it’s not necessarily correct. However, as it opened the door to the creation of both The Suppliers Butterfly and the RES equation, for posterity the source is presented.

Just as the discovery of the accelerated growth pattern created by the “POP” principle was only realised whilst creating a graphic, Quantum Force Theory and its tangible cohort the RES equation started in a similar way.

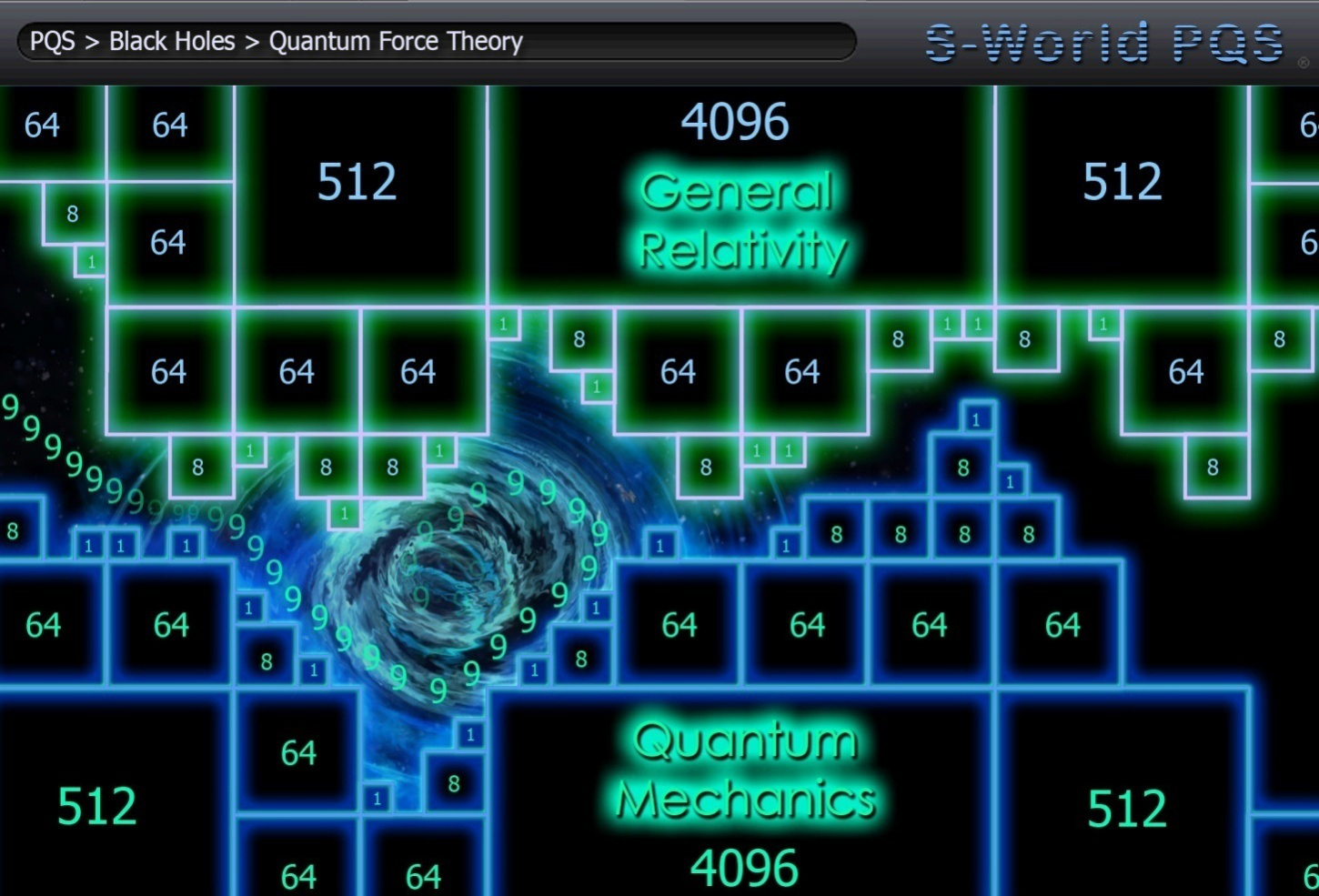

The objective was to show all the post 2036 USA networks in one graphic, where as soon as the networks and then their strings became stable they grouped themselves into cubes of 8, 64, 512 and 4096.

Practically this graphic did not work, as the visualisation needed to be in 3D. The boxes needed to come out of the USA map and there needed to be a provision to see holes in the larger cubes where unstable networks were. It did however present a starting point for looking at POP growth over time.

The concept was, and still is, to be digitally rendered within a hologram, which can be navigated by the human hand, as seen by a sensor. With a time slider so one can visually move through the years, seeing each new network appear within the cubed structure, as and when they are forecast to become stable.

At the same time as this graphic was being considered, in March 2012 I watched two documentaries in short succession. The first program was on physics. The documentary highlighted an important mathematical detail in regard to unifying Quantum Mechanics and General Relativity within the measurement of Black Holes and the Big Bang. The reason the two sets of figures will not marry was due to results leading to an infinite number.

“Quantum Force Theory” was a simple adaptation of CFM and POP applied to the problem of the infinite number. I considered it from a mathematical vantage point. If the experiment was run again, this time blocking any calculation that created a periodic recurring number and freezing any calculations that went passed processing power, and in a POP like manner, attempted to contain the numbers within the CFM cubed structure. The expected result may look like something like this:

Looking as the problem from this perspective and from this vantage point, one can’t help but look into the gap. No longer was the problem within General Relativity or Quantum Mechanics, the problem was within the gap.

The graphic shows two definitive stable sets of mathematics and a gap of uncertainty. It was considered, “within this gap, something surprising might be found, maybe a force or frequency”, and so the theory was named “Quantum Force Theory.”

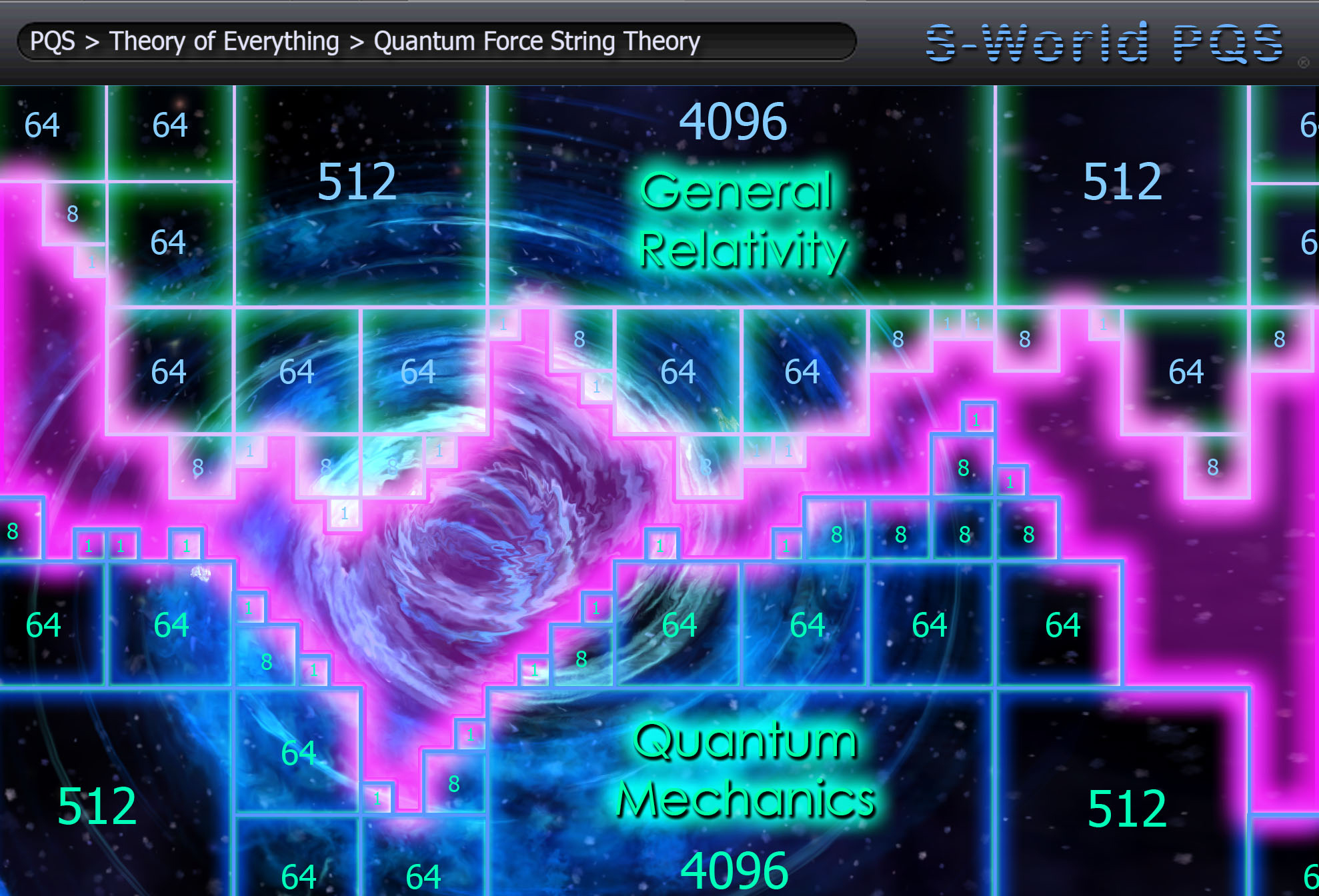

A question that sprung to mind was: “Is the gap String Theory?” To assist this contemplation, I created an additional graphic entitled “Quantum Force String Theory”

In the here and now with the help of Dr Amanda Peet, the Quantum Force Theory graphic would appear to be incorrect. As when computing the probabilities of gravitons (the particles that transmit gravitational force) scattering off one another, we discover that the energy required, grows with the square of the energy. So if you double the energy, one increases the probability by four times and if you triple the energy one needs to multiply the probability by nine times. At very low energies, this is fine, but at very high energies as would be found within black holes or at the creation of the Big Bang eventually the probability would exceed 100%.

This being so, the Quantum Force Theory graphic should see the quantum calculations overlapping the ones from general relativity. This said there is a possibility the string theory graphic may be correct when the extra 6 dimensions are factored in.

Correct or not, having created the graphics and enjoying the experience with the practice of identifying the gap on my mind, when by coincidence the next day a Newsnight programme on economics in part blamed the financial downturn on governmental economic black holes. The idea of “analyzing the gap” within an economic black hole led to the consideration: If POP and CFM techniques could identify the problem area within the search for gravitational unity within an astrological black hole, the same principle could be adapted to work for an economic black hole. If the problem area could be identified and quantified, it could be tackled and reduced.

On consideration in network terms an economic black hole simply became…Money that left the network.

Fortunately, much work had already been put into doing just that. In particular the financial software dictating the ordering process, so companies within the network could only order (except in exceptional circumstances) from other companies within the network.

Economic Black Holes and Quantum Economic Efficiency Scores

Not long after, Baby POP was discovered and the “Suppliers Butterfly” was written into “The Theory of Every business,” highlighting the various advantages the network offers including the guaranteed tenders as provided by the M⇔Bst.

The general thinking in relation to tenders was that collectively each Resort Network would see about $2.5 billion in construction costs. The objective was to minimise the money that went missing, maximising the profit vs. revenue of each company, alongside the companies it purchased from. Whilst remaining competitive and allowing generous profit share for the staff. Profit share that was to be paid in “network credits,” and as such, alongside all orders made by network companies, all profit-share would be destined to stay “in house.”

Direct salaries were the hardest to contain. This problem was later addressed within the design for S-World UCS, which we will take a brief look at in a moment.

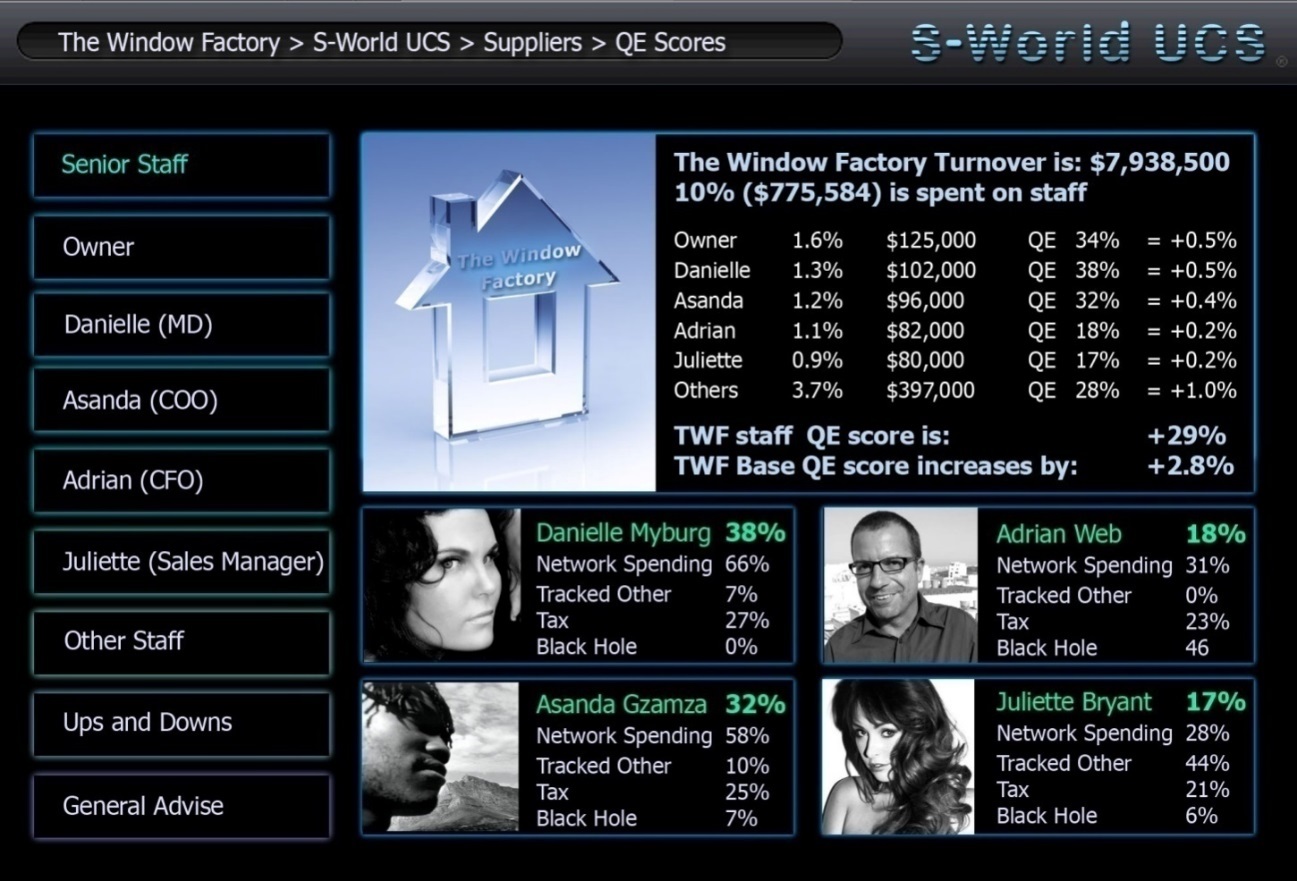

Staying with the basics for now, below is the 2018 Window Factory “Suppliers Butterfly” QE Efficiency spreadsheet, (the “E” being the “E” within the RES Equation).

Looking at the spreadsheet below, firstly In row (c) we find The Window Factory’s “Profit vs. Revenue” ratio is 30.8%, this figure is the total company profit from row (b) $2,441,125 divided by the total company revenue in row (a) $7,938,477.

Next we follow the rest of the money which equals $5,497,431 and look to ascertain how much of that goes to network companies and how much leaves the network. At this point we are no longer looking at the profit vs. revenue ratio of an individual company, rather the profit vs. revenue of all companies benefiting from the initial Window Factory revenue of $7,938,477.

We call the combined profits made from the Window Factory and all suppliers and staff spending on networks “Quantum Economic Efficiency” (QE Efficiency).

For this exercise, with the exception of staff, we have estimated all suppliers’ companies have a 54% QE Efficiency.

As such in row (d) we see the $3,175,391 spent on suppliers, is multiplied by row (e) the 54% QE Efficiency of the suppliers. Which in row (f) generates an additional $1,714,711 in profit for the network. Which when added to the initial $2,441,125 made directly by The Window Factory equals $4,155,836. When this is divided by the initial revenue of $7,938,477 an overall QE Efficiency of 52% is attained.

Added to this comes some smaller contributions from media companies, staff and miscellaneous spending. The eventual tally of $4,657,526 gives The Window Factory a QE Efficiency of 58.9%, as such, for every dollar spent at The Window Factory, the network, as a whole generates $0.59 cents.

As such, if this were an average result within all the building companies within a network, of the $2.5 billion that is to be spent on building, nearly $1.5 billion will be returned as profit. This is $300 million more than all the profits required from all companies for the first 3 years of the Baby POP spreadsheet. Every cent created by the remaining 87.5% of companies would be additional profits above target.

Staff QE Efficiency encouragement

Money leaving the network via staff is the hardest to contain. Without getting overly detailed, the screen shot to the right for S-World UCS illustrates how staff is encouraged to attain high personal QE Efficiency scores. The bottom line is, when it comes down to payment of bonuses and profit share, (which by 2018 would be approximately equal to their basic salary), the higher a staff members QE score, the more they will receive of this bonus pot.

The figures below are worked on all staff receiving the same basic salary. But as 66% of Danielle’s spending is spent on network items, where as Juliette only spent 28%, this being so, Danielle receives a combined salary and bonus of $125,000 compared to Juliette’s $80,000. And in doing so, encouraging and incentivising all staff to spend their salary on network items.

In reality, the actual difference in bonus payments to staff due to their QE score would not be quite as severe, as performance statistics are considered alongside EEE Points, which get awarded for doing things that benefit the network and/or the planet.

There is however a significant incentive for staff to wherever possible spend money within the network. Particularly when it comes to property, as for many that would be their greatest single financial purchase. When we consider the butterfly, cause and effect logistics; this initiative will add significantly to the desirability of purchasing network built properties.

(Note 1: A word on the math in the graphic, we see Danielle spends 66% of her income, but only has a QE score of 38%, this is because her network spending needs to be multiplied by the QE score of the companies she purchased from, in this case an average of 58% was used. 66 x 58% = 38%.)

(Note 2: This example is a small demonstration of how attempting to improve game play in S-World UCS, created a useful parameter that could be applied to the day to day workings of the network.)

It’s difficult to judge exactly what the economic black hole is within the USA, or indeed how you would exactly quantify it.

We do know the average Fortune 500 companies generate 7.5% in profit compared to what it takes in the tills. And it would seem the average small business in the USA makes between 5% and 15% profit. But what that equates to as a QE score is incalculable. There is no way to track the money through the current system with any degree of accuracy. All that can be said with certainty is it would be significantly lower than the collective businesses within the network.

The RES Equation: RES>=+100%

Technically the RES equation was created to answer a question: “If the network were to become the hub of world trade, at a fixed network profit vs. revenue (QE) efficiency of 75%, how many times will the revenue need to circulate within one year to create growth?

The equation: R (Revenue) x E (Efficiency) x S (Spin) must = over 100%: RES>=+100%

(the > symbolising “must”)

However, whist exploring the mathematics it became clear that given the controls within the network system, the RES equation could be used to continuously stimulate the network economy. In essence giving the benefits associated with the M⇔Bst equation in terms of additional trade to all network companies.

As a further advantage, presented correctly, it would give a clear cut example of how the “Give Half Back” process when combined with “Economic Stimulus” generates more profit for companies than they have given back.

What we wish to demonstrate is the RES Equation’s ability to turn one dollar made in profit by any individual network company, into two, three, four or more dollars in the combined networks tills.

RES Equation Examples

Three examples of the RES equation are presented. First is a simple example of how profits can be doubled following which is the latest update to a continuing “work in progress” that considers RES within GDP. This example is presented as “let’s work on this some more,” not “this is how it is.” The concluding point is practical, specific to network profit centres.

RES equation example 1

To start with we look at a network (collection of companies) that has generated $1 billion in profit. And we assess what the (R) (Initial Input Revenue) would be if the companies combined QE Efficiency was 55%. Working the maths backwards we find $1,818,181,818 times 55% gives $1 Billion in profits, so we have $1,818,181,818 as the Initial Input Revenue. The R in the RES equation equals $1,818,181,818

Now we need to add the spin.

Using a starting profit of $1 billion and by ensuring profit is spent within 4 months, be it via POP, purchasing, network dividends, profit share or any other method of distribution, then the network will create an additional $550 million in profits, as $1 billion x 55% is $550 million. This is one Spin, (The S in the RES equation)

Next we repeat this process, so the $550 million is spent within four months, creating a further $303 million in profit. Lastly this $303 million is also spent within four months, creating a further $166 million. Adding up all the profit as a whole the network will have generated over $2 billion in profit.

Where this leads to is a consideration.

Before applying RES, as long as a network can expect $1 billion in profit, by applying RES “in general” to the network, the network as a whole will have generated over $2 billion in profit, from the original $1 billion profit.

RES equation example 2 – the Big Picture (work in progress) (very important point)

Next we take a relativistic (big picture) example and consider a point in the future. Where the efficiency of the network has engulfed our current economic system and the network is by far the greatest contributor to Global GDP (Gross Domestic Product).

First of all, we need to define GDP, on the US Debt clock. The CBO (Congressional Budget Office) describe GDP as “A basic measure, of the market value of all financial goods and services, made within the borders of the USA, in one year.” I believe it would be more accurate to add “and sold” to this statement. As companies in the USA could make a trillion dollars worth of cup cakes to boost their economy, but if no one bought the cup cakes, it would ultimately be a loss making exercise.

The second oddity about GDP is its initial cash input: In 2012 we see global GDP at around $70 Trillion. However this does not indicate an Initial Input Revenue of $70 Trillion, as money circulates and goes through the system.

For example: If I spend $20 in cash at a Pizza restaurant, $20 is notched up in GDP. However at the end of the week that $20 note may find its way into a pay envelope, where after the recipient pays his or her rent, now $40 is notched up to GDP. Soon after the landlord may spend the $20 dollars at a shopping mall, where after, the shop it was spent in may use it to pay their electricity bill. This could all happily take place within a month or two and have generated $80 in GDP, from an initial input of $20.

On the other hand, the pizza restaurant owner may have put the money in a bank and not take it out for ten years.

Initial Input Revenue is the amount of revenue entering into the financial system, not its subsequent re-spending. Working out exactly what the Initial Input Revenue of Global GDP is, is not a simple task. If you asked me to hazard a guess of how much Initial Input Revenue was put into the system to generate the $70 trillion in GDP last year, I really could not do so. But for the sake of starting with a figure I’ve gone with $28 trillion, albeit, it could conceivable be quite a bit lower.

Before examining how the RES equation works with GDP, another consideration needs to be presented, if the network was generating most of global GDP, then the average network companies QE Efficiency would be greater. As in general, most items were already being purchased from one network company or another, as such staff QE Efficiency would rise.

As a last consideration we need to factor in Cash Flow vs. Profit. Currently GDP is calculated by cash flow, regardless of profit. However, when it comes to network economics in its finite manner as presented within this example. With the exception of tax, as every cent paid to every company involved in any sale is recorded as network profit at one place or another, network profit is much the same as GDP.

In the first spreadsheet below we consider the average QE Efficiency of a network company to be 75% with tax accounting for 25% and no Economic Black Hole. In essence a society where cash is replaced with network credits. The second spreadsheet increases the tax threshold to 30% (Note: the tax threshold is considered a total of all taxes).

Starting with our guess of $28 Trillion as the Initial Input Revenue of Global GDP, we see that despite 75% financial efficiency, if the money does not circulate, there is only $21 Trillion created in profit.

At this point the network economy would have shrunk by 25%. RES=75% the equivalent of the USA posting minus 25% growth figures, as opposed to their +1.7% last year. For economic growth RES needs to equal over 100%

The situation corrects itself as spin is applied, as seen in rows (c) to (g). Please notice that for this example the figures have been worked out by including 50% of tax revenue within the spin calculations, as we are working on the principle that as the network is ever present, it would make sense that at least half of tax revenue was spent on network items, or staff who would spend their salaries on network items.

The effect of the five spins generates $64 trillion in profits. Which when added to the Initial Input Revenue of $28 trillion generates a total of $92 trillion. This figure would appear to be the equivalent of current GDP.

Looking at tax, we see a global collection of just under $27 trillion, with the USA collecting $5.8 trillion, 20% up on current receipts. Continuing with tax, the bottom spreadsheet looks at an increased tax threshold of 30% which increases tax revenues by 9% but decreases GDP by 13%. However this decrease would be less severe if more than 50% of tax revenue was spent on network items, which in this scenario is likely.

Due to the five spins applied one thing in particular worth noting down. That the network profit has increased by over 400% from $21 trillion to $85 trillion.

Finally we see in row (n) that an annual growth figure is not presented. This is due to the Initial Input Revenue, which is not as simple to control. On the 25% tax model, an increase in Initial Input Revenue of five trillion shifts our GDP up 18% to $108 trillion, whereas a decrease of $5 trillion decreases our GDP 10% to $83 trillion.

Of course there will be many ways to program the system so as to stimulate Initial Input Revenue. However, it is the one factor that will always have variance due to human choice. Currently US companies are sitting on $2 trillion and China is sitting on more. If they were to spend this money, due to the natural spin within current economics, it would appear that it would have the effect of increasing global GDP by over 10%. And the world would record its most profitable year. A 10% increase in Global GDP would be recorded in financial history as a golden age.

There is another source of money that simply sits that is far greater than that of China and the US companies. That is the wealth of the top 2% of high-net-worth individuals in the world. The exact figure is not available, but they have a lot. And most of it does not get spent in ways that increase GDP. We already have an idea or mechanism in place that attempts to activate this wealth contained within the Facebook business development plan “Lx.” Which if we remember generated over $2.6 billion per US Mother Network.

Within the American Butterfly business plan as a whole, this profit centre has been excluded as it was not deemed “highly probable.” However with the aid of the RES equation, understanding just what a difference that money could make, there is another good reason for giving it a go as it also backs up the previous statement on this profit centre. That it would not be taking a portion of GDP or taking market share from another. Rather creating a new profit stream. So long as the top 2% of earners saw value in spending their money it is a win/win/win scenario.

In conclusion, I hope it is plain to see just how controllable the global economy would be if/when the network becomes the world’s main trading hub. By simply increasing or decreasing the amount of spin we cannot predict what GDP will be, rather we can make it so.

It has always been the founding principle of the network. That as we cannot predict so we need to enact, this from the first founding network physics philosophy as provided by Isaac Asimov and introduced by Anthony Rauba:

“You may not predict what an individual may do, but you can put in motion, things that will move the masses in a direction that is desired, thus shaping if not predicting the future.”

RES equation example 3 – Practical, Tangible and Usable

In chapter five of The Theory of Every Business we find the section: “Economic Stimulus & Investment”

Within this section we see how the first $1 billion in combined company profits might be spent by a network, including the Baby POP process.

For a standard Mother Network which generates $1 billion in profit, when all is said and done, $150 million will be spent on operations. $525 million will be investment into Baby Networks and $425 million distributed in network credits to shareholders and staff.

(Note: The figures show over $1 billion due to profit share being paid to staff in network credits adding to the Economic Stimulus total, alongside the operation centre making direct profits lowering the actual GHB (Give Half Back) commitment.)

Now, with the help of the RES equation, the benefit created from “Economic Stimulus” can be calculated. Working at a 55% QE Efficiency the economic stimulus will generate $425 x 55% = $233 million.

With such profit being recreated, we consider applying more profits to “Economic Stimulus” and look for clever ways to give away money. Which when all is said and done increases the overall profit of the network. In such considerations we apply the “⇔” feedback arrow from the M⇔Bst equation (originally from the Mandelbrot Fractal).

And so the equation adapts to RES>⇔+100%

To continue we need to make a reasonable estimate of a Mother Network’s typical profit in 2018.

Starting with the Facebook figures as presented in The Theory of Every Business and further considering the revenue and profits made by their suppliers applying a 50% QE Efficiency. We forecast just over $3 billion per US Mother Network.

However, as a result of consideration of the RES equation, the “Lx.” concept has adapted and developed significantly and is now being developed as a major profit centre for American Butterfly part 4: “The Butterfly.” Until fully developed it shall remain as a significant bonus profit centre. This being so the Facebook profit centres have been rounded down to $400 million.

Added to this are the various S-World affiliate initiatives, the profit projections made for priority partners: the other technology companies, media companies and possible pharmaceutical companies, which we hope include Apple, Microsoft and Amazon alongside most of the technology and media sector.

Details on this profit centre are presented within American Butterfly parts 4 and 5. And will in all likelihood be rounded up in a dedicated section in American Butterfly part 6. For now we work on a simple assumption that the rest of the sector combined should double Facebook’s profits. So we add $800 million.

To this we add the $245 million generated from 12.5% of the network companies applying the “Suppliers Butterfly.”

Thus far we have included 25% of the network as essential partners and 12.5% as building supplier companies. For the balance of companies we use the lowest fifth year 40% (RNL) investment vs. profit statistic, as such with an investment cost of $2 billion multiplied by 62.5% participation and a 40% investment vs. profit statistic we arrive at $500 million.

At the starting point of this example we began with $1 billion in profit already used up, with $525 million investment into Baby Networks and $425 million distributed in network credits, to shareholders and staff.

Of this $425 million in “Economic Stimulus” network credits, $100 million has already been assigned to Facebook Stores and the profit accrued. The rest which is $325 million is to be spent directly in the network. Or by a rather complex network exchange system spent on other networks where by trade off’s the original network sees the benefits. So creating an additional $325 million x 55% (if E = 55%) = $179 million in profits for the network companies.

Now, total network profit = $1.945 million + $179 million = $2.124 billion, from which we remove the initial $1 billion that has been spent, leaving $1.124 billion.

At this point we are over the $2 billion mark. Which in trusting the original POP system as supported by the Give Half Back initiative means by rights we should have an even split of the first $2 billion: 50% should go to POP Investment with the balance paying for other items, with all overflow (the $124 million) also going to POP Investments. However with the addition of “Economic Stimulus,” and “Spin” an adaptation presents itself: 50% is used for POP and 50% is used as Economic Stimulus, with operational costs mitigated as much as possible (as always it’s a work in progress).

In this example, so far $425 million has been created in Economic stimulus. And so, of the $1.124 billion $575 million should be added to the Economic Stimulus network credits kitty. However as the additional business see more staff bonuses, which are effectively economic stimulus, only about $500 million would be needed to hit the $1 billion mark.

Effectively at this point we see about 25% of network profits. Communally pulled and used specifically for “Economic Stimulus” to be distributed as network credits, which all have a time limit on their spending. At this point any company, whose profit is garnished, is well aware it’s going to happen. And will already be making an excellent return as well as also aware that this very act is continually stimulating the network economy. Thus this protects the very mechanism that made them the money in the first place, whilst guaranteeing its continual growth.

And so, on the task of working out the best ways to distribute the $500 million in network credits and in terms of both immediate return via RES, alongside other benefits.

Currently the focus is on three types of distribution, all of which were previously earmarked for extra investment, as a guarantee of creating the necessary market dominance to be certain of S-World profits. (The largest profit centre)

Other possibilities I’m sure will present themselves in time particularly in view of Special Projects. However this distribution, ultimately, when all factors are considered makes the giving away of $500 million in network credits per network, a profitable exercise.

1. Sports

2. Media and Entertainment

3. S-World

The most effective multi-reward distribution method considered so far is the sponsorship of semi-pro sports teams. Looking at the long term macro view but also considering the advantages will be beneficial for the network at any time.

We take the 314,000,000 people in the USA, and deduct a third, as they may be under 16 or unable to play sport. Then we divide by the critical mass of 8,192 networks. This leaves 25,298 people per network. The network utilises $100 million in economic stimulus network credits, and creates a league structure of many types of sports teams, playing 30 games a year.

If this is so, on average each US citizen that can play sports would receive $132 for each game played, a fair semi-professional sports gratuity. Chances are of course that out of the 207 million people who could play, only half of that number ever will, so increasing the gratuity to $264 per game.

To raise the stakes, whilst still looking for good ways to distribute the network credits, one can assign $50 million to the professional sports division, each network offering over $1 million in prize money for many sports. With a catchment of only 25,298 people and maybe sixteen $1 million prizes per year available for different sports, our new semi-pros are highly motivated to do well. Alongside this, $9 million may go to local sports teams to help with facilities. This is alongside $25 million collected from each of the eventual 8,192 networks creating $200 billion in funding and prize money, for the elite sports men and women within the USA. To put that into perspective, last season Chelsea Football Club won the world’s richest sports prize; The Champions League, which paid them $47.7 million. This is 400 times less than the spots prize kitty for the USA networks, and 1600 times less than the global prize kitty.

Multi Reward: Moving back to 2018 starting with an E of 55%. We already know that of the $150 Million assigned to sports $82.5 Million will be automatically returned to the network as profit. (Or $112.5 million if a QE Efficiency of 75% is achieved). On top of that, should credits be valid for only a month to spend them, a third of all local residents will come and visit a Resort Network every month, creating the “full restaurant syndrome.” Thus making resorts constantly alive, and of course, when people come they may often spend some of their own money as well.

Such an initiative will create a media monopoly on sport, so if desired. Device manufacturers and broadcasters outside the network would not be able to broadcast any sports. There are sponsorship benefits of course and TV rights to be sold. But the crown in the sports economic stimulus initiative is a fit and healthy US and global populous, saving hundreds of billions in medical costs. But in my opinion most importantly also creating a more alert and more team savvy as well as a social work force. As they say, a healthy mind in a healthy body.

All told, when you add it up, the Sports Economic Stimulus initiative would be a profitable endeavour. Giving away $150 million in network credits, ultimately a profitable exercise.

Similar considerations and advantages also come from spending the money on media, entertainment and encouraging people to use S-World UCS.

Of the extra $575 that registers in the tills of the network 55% would be returned as profit, equalling $316 million and increasing the total network profit to $2.44 billion. At this point, in the same way that The Window Factory benefits from tenders provided by its future Baby Networks, by following “The Suppliers Butterfly”, a further $1billlion in revenue has been artificially injected into other companies. For them all to benefit in much the same way, increased trade.

Of the extra revenue generated over $ 1billion, $944 million is added to the initial $525 million in POP totalling $1,496 million in POP investment.