tfs-total financial system

Chapter 7. The TFS™ – Total Financial System

A primary objective of S-World Villa Secrets is to create a simple financial system as a part of the web framework, that provides managers with weekly management accounts, and avoids human error. Stage 1 due for release four months after the sale of the first primary network.

Index

-

Chapter 7. The TFS™ – Total Financial System

- Part 1. Data Entry

- Part 2. Data Sorting

- Part 3. Data Reporting

- Part 4. Sales Funnel and Enquiry Stats

- Part 5. Auditing and Tax

-

Challenger Sale Step 5. Emotional Impact

- Step 5a. The Landmine of Negligent Accounting

- Step 5b. The Problem of Poor Accounting Software

- Step 5c. The Landmine of Accounting Fraud

- Step 5d. Not Receiving Month End Financial Reports

- Is Unique or performs better than competitors because…

- Key Benefits and/or is a Solution to….

-

4 Barriers to entry

- Barrier 1. Fatal Error in Auto forms on Most Browsers.

- Barrier 2. Same Problems for VAT

- Barrier 3. Do not incentive clients to move their companies abroad

- Barrier 4. No tutorials or videos on a highly complex system

A Software, Systems, and Behavioral Science Critique of the UK Corporate Tax & VAT Systems.

Chapter 7. The TFS™ – Total Financial System

By Nick Raymond Ball Summer 2017

Originally written in the summer of 2017

With additions from May 2018 found it the latter sections

Since 2011, the primary objective of S-World Villa Secrets, in terms of systems, has been to create a simple but all-encompassing financial systems as part of the core software design.

In 2011, the first version of this business plan (found here) combined a CRM (Customer Relationship Software) alongside a financial system, and a GDS (Global Distribution System) which provided access to online availability, as is now presented in the Chapter 5. The Villas Cloud™.

Before we delve in, a quick summary of the development timetable; which would be about 6 months to an alpha version, which will be all that is needed to give management the correct overview, showing monthly income vs expenses and profit and loss.

First, a brief description of the 5 points that were identified in the TFBS design from 2016, found here: Network.villasecrets.com/total-financial-business-marketing-system/tfbms-part2-total-financial-business-system.

Part 1. Data Entry

To avoid human error &/or fraud since the original ‘SIENNA Software’ plan in 2011, the software has been specified to capture financial data from the bank; this is in place of an admin or the financial staff members copying data from the bank’s website to a financial system or spreadsheet.

Banking APIs (connections from a bank’s system to yours) are becoming more readily available and cheaper in the UK. However, we are not starting in the UK, and we need to make our system connectable to any bank in the world, so we are creating a simple bank CVS spreadsheet download and upload system.

In short, any staff member with access to the bank’s website can download a CVS spreadsheet. And we also ask that they take a screenshot of the bank’s online page that includes the running balance (for added security). Then, the spreadsheet and screenshot are uploaded into the TFS™, the running balance is entered, and the data is in the system.

The one problem we have is when two payments for exactly the same amount with the same reference are made on the same day. In which case, the running balance will be incorrect, and one must look for the duplicate payments or debits and add them manually. However, this event would not occur often, especially not in high-end real estate and travel.

Also note that the initial data from all agent and online bookings is already a part of the system, the data is already in the CRM. So, for almost all expenses, except one off purchases, there is no data for financial admin to add.

There is a significant time saving cost to this method, so one staff member can do the job that used to take a whole team. And of course, a system that is free from data capture errors is priceless, as it makes the system very hard to trick or defraud.

Part 1. Data Entry – 2018 Update

A lot can happen in a year. In my case, after completing the first draft of this book, in August 2017, I started work on American Butterfly (2012/2013) edition 2; this time under the title Angel Theory – Paradigm Shift.

After a number of breakthrough chapters, I am now confident that (one way or another) I will get the development team I wish for and that I can create the TFS (Total Financial System) directly with a bank or banks. It may not immediately cover every country, but as long as it can cover every currency and receiving money in that currency does not invoke an exchange rate cost when the payment is also in Rand, it should be fine.

So, the plan is to create a system that draws its data straight from the bank; which creates an added advantage of making it possible to make auto payments, significantly reducing admin hours, making a better service as suppliers are paid as soon as the money hits the bank, and further reduces the risk of fraud.

Part 2. Data Sorting

Once the data has been fed into the TFS™ and the running balance is seen to be correct, that data is sorted into sections and sub sections, just like one would usually see from an accountant or accounting software, separated into different columns for different types of expenses and inputs which can be customized anyway we wish. This system is not just for recording accommodation payments in and out, it is for every expense from personnel to light bulbs.

For all transactions that have a specific recipient code or name (such as ‘John Smith Salary’ or if a villa payment with a reference number such as ‘#2613’), the receipts and payments will automatically be assigned to the correct section. And in the case of income from clients, the system will create a message about the payment to send to the owner.

There will always be a degree of human sorting, credit card payments for instance. However, with most data being auto sorted, the list of available matching payments to choose from will be small and easily managed. The system will try to exact match the amount. And if it can’t, it will provide a list of potential matches, most likely at the top, really making the banking child’s play.

This system is designed to work for every single transaction, making the entire business banking process simple and extremely efficient. Of course, it would be better off if all payments were made automatically; but this is only possible with banking APIs, which are a later version of TFS™. Stage one is purely about making an accurate system that is almost impossible to fraud or create errors in, that can be presented simply to the C-Level managers. And so, S-World Villa Secrets can see the almost real time financials of all the business, presented simply and more complex, depending on who is monitoring.

Part 2. Data Sorting– 2018 Update

As previously mentioned, we are now aiming at an integration with a bank; auto banking can automate most payments saving time, increasing accuracy, and lessening the opportunity for fraud.

Part 3. Data Reporting

With all the banking data now placed into the correct categories and sub categories along with required fees presented for payment, updated 3 times or more each week, the system comes into its own when it comes to reporting.

An accurate report of debits and credits presented as management accounts is essential in business when it comes to making, spending, and hiring decisions.

This is so the CEO and the management can clearly see the profitability (or not) of the company in almost real time.

In addition, in business transactions where payments are not uniform; for instance, payment may be in full or a deposited amount. And in the case of some booking channels like Airbnb, bookings are paid in arrears. The TFS™ will provide the all-important ‘stand still’ figure. (If all credits are received, and all payments made, what is the balance?)

To further assist, using past data, the TFS™ will also provide reports that compensate for seasonal trends.

In addition is the ability to provide up to date financial reports to clients as soon as their payment hits the system or is paid to the villa owner; or if a concierge payment is made, it will update the Client Suite.

Part 4. Sales Funnel and Enquiry Stats

The CEO and management will be able to see a very real picture of how one is doing in a month. Judged not only on income received but by how each sales agent is doing. One also has a very good indication of the value of enquires and each sales person’s enquiry VS closer ratio. Drilling down deeper, one can assess which agents perform best with which enquiries, and better order the allocation of enquiries based on such data.

Part 5. Auditing and Tax

Once one has the organised data, we desire the final part of the system to correctly present and pay taxes and be ready for an Audit if necessary. Each country has different tax and filing guidelines as well as rules which everyone should abide by. However, this is simply another set of rules to add to the system. It’s simply reporting in a specific format.

Part 5. Auditing and Tax – 2018 Update

Actually, experience now shows that the tax system in the UK has proved to be not fit for purpose. I have added a significant update to this ‘Auditing and Tax’ after the following sections: Emotional Impact, and Key benefits and/or is a Solution to.

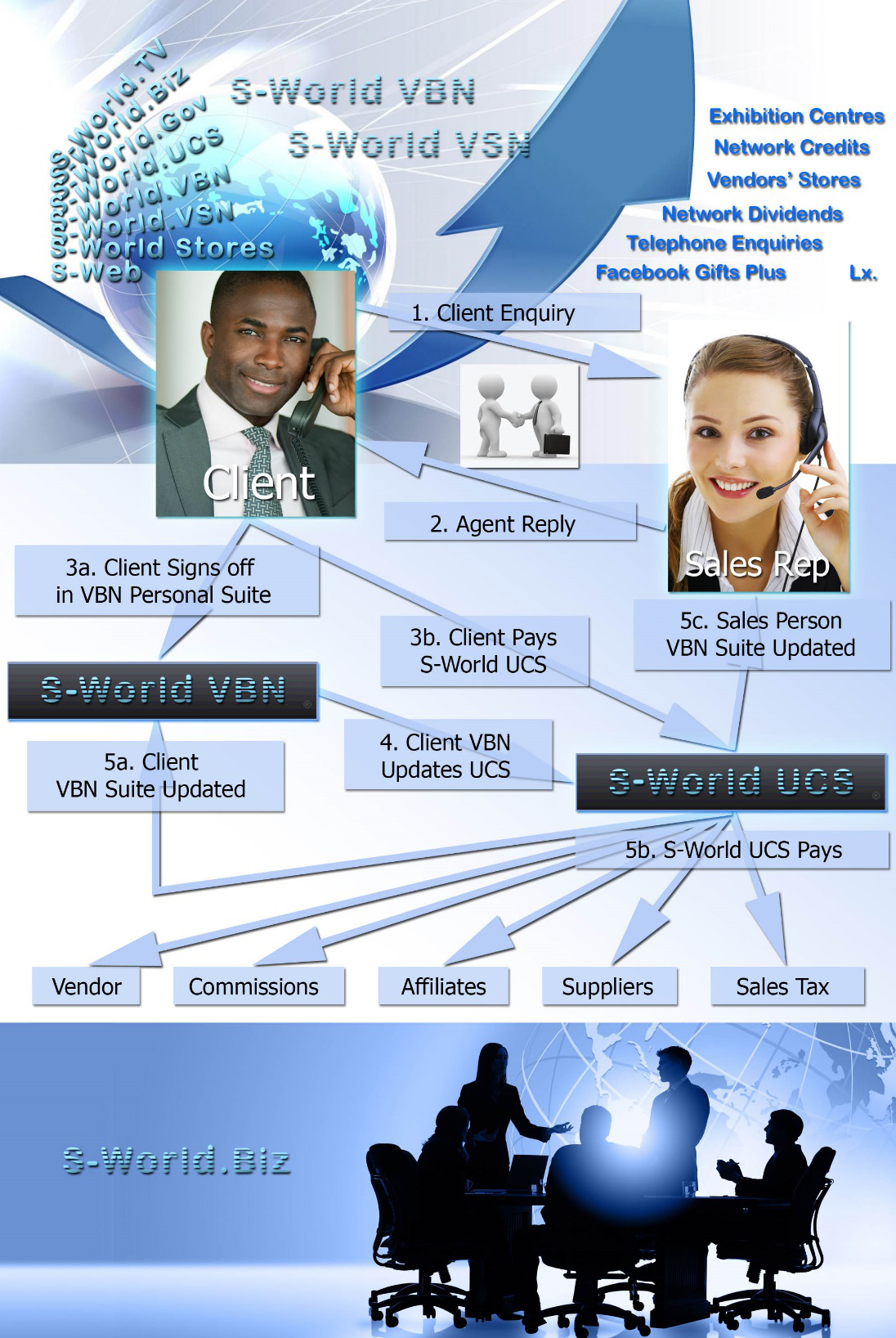

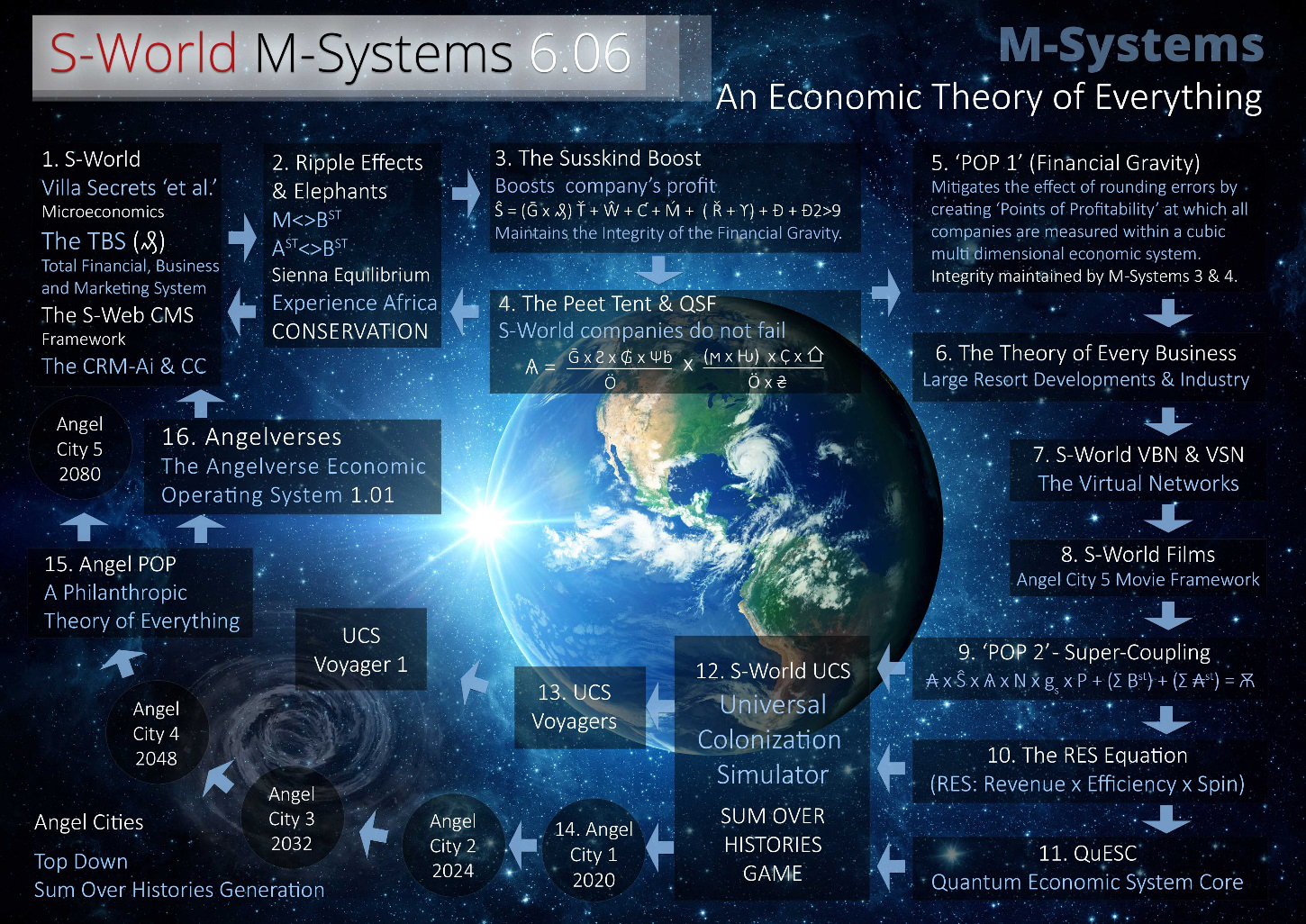

The TFS™ Design from 2012

Below, we see the original TFS™ design from 2012, from the first S-World Book ‘American Butterfly – The Theory of Every Business’ http://americanbutterfly.org/pt1/the-theory-of-every-business/ch7-s-world. One needs to replace the word ‘S-World UCS’ with The TFS ‘Total Financial System.’

To conclude this section of this chapter, we present the usual ‘problems, opportunities, unique systems and solutions.’ But this time with a little more passion, as we describe the mountainous problems I had with accountants and accounting software between 2004 and 2010 that almost crippled the company.

If one is reading this from the perspective of ‘The Challenger Sale,’ this section provides data that one can use to create an ‘Emotional Impact’; albeit, this will only really hit home with smaller companies, as most big companies (and in particular established real estate companies) will most likely have fixed the following problem long ago.

However, I have extended this section to include the problem of key staff and agents leaving to join competitor’s companies or creating their own; which is a significant problem in the travel and real estate industries, particularly at the top end.

Challenger Sale Step 5. Emotional Impact

In the early days, all was fine with the accounts; which I did myself after some initial guidance. Until the end of 2004, when we were robbed, including my laptop that I had not backed up for a few months; where after, I was so behind we hired a bookkeeper who worked at our accountant’s office. Unfortunately, the company boss, who was my contact, was going through a very messy divorce and was completely distracted. So, instead of working from the spreadsheets we had created, they used the accounting software Pastel, and did not account for final balances. So, a few months into 2005, we realised that guests had not been invoiced for final payments, and this was an expensive lesson.

But nothing in comparison to the following 5 years…

I shall tell this story framed within Problem vs. Unique Solution Points.

Identify Problem – Present Missed Opportunities – Avoid Potential Landmines.

1. The landmine of ‘Accounting so Negligent it may as well be criminal.’

Leaving one’s accounting and admin to professional accountants, or an in-house bookkeeping team is a risky business. In my experience, in both the UK and South Africa, from bookkeepers to experienced financial officers at BDO, to the 5th biggest firm in South Africa, they all get it wrong.

And in some cases, they get it badly wrong, then rub salt into the wound by becoming the single largest expense in my company (at 25% of Gross Profit in 2010,) that their actions threaten the very business they are paid to assist.

Like lawyers, accountants are not paid to help or fix your business in any way, accountants’ priorities are to create reasons for billable hours.

A real example of this was for BDO for Cape Villas in 2010, who started with a $150,000 VAT error; as either they did not check or know that there is no VAT for foreign holidaymakers, or they did know but decided not to share this information as calculating the VAT was worth $25,000 for them. And at the same time, the CEO said he loved the business and would offer business advice not specific to accounting; but neglected to suggest that as our property management division was causing 95% of admin and admin and property management was costing 20% of gross profit, if we outsourced the property management (which would have been relatively simple), we would save 20% a year from the department, and another 25% from the financial department. A 45% saving that really would have made a massive difference.

But of course, when the CEO said he loved the business and would offer business advice not specific to accounting, what he forgot to say was, ‘so long as any advice I give does not decrease the amount of accounting you need.’ As a result, 45% of all 2010 gross profit being about $250,000 was, in one way or another, wasted as a result of BDO accountants.

This came just 18 months after the previous financial manager resigned after making a plus minus $150,000 reporting error; which lead to $150,000 of spending on offices and launching a new brand that we would not have done had we been given the correct financial stand still.

The above very true scenario is probably the biggest landmine any company could face.

2. The problem of poor accounting software.

Even after spending hundreds of thousands of dollars setting up the Pastel accounting system (preferred by accountants in South Africa), the accounting software did not account for moving clients from one villa to another, if for some reason the first villa is not suitable. I personally tested this in 2010 by asking the financial team if they had reconciled such an event and was amazed to find that the system could not detect such actions. And if not for my personal intervention, we would have lost $4,000 which, on its own, was not a make or break problem. But, as we would regularly change villas, this problem adds up to a significant problem.

3. The landmine of accounting fraud.

And yet the woes continue. As before the big accounting firm and the financial manager; in 2007, we had our best year to date, but had lost money. When we called in the financial manager, he reconciled the books and found about $80,000 missing, and fraud charges were placed against the previous financial manager. But this could not be investigated, as the fraud squad wished us to pay $250,000 to Price Waterhouse Cooper to investigate, and we could not afford it.

4. The unexpected large landmine of not receiving month end financial reports.

To the credit of BDO in 2010, they provided month end reports. In over 7 years, I was never given a month end repot. Only when BDO came did I receive this. Month end reporting is a completely essential tool that should be the first thing anyone with any experience in accounting or bookkeeping should know that they need to produce.

However, like many business owners, I simply did not know to ask for this, having paid money to others to take care of this department. I buried my head in the sand under the expectation that the people, who did this for a living and where trained for this at the university, knew what they were doing.

Big mistake, as by the time BDO did present monthly financials, there were some very big unnecessary costs that needed to be trimmed. And due to the other losses, or in the case of 2009 and the misreporting which lead to $150,000 of spending on offices and staff that was not necessary, we had to create such a massive contraction that it sucked most of the talent out of the company.

All told, it’s a wonder that Cape Villas did not go bust. It surely would have done if not for my ability to find new ways to improve, to the point that when the recession of 2008 and 2009 and 2010 were affecting the rest of the world, Cape Villas had its three highest grossing years.

But as night followed day, for every new way to increase income, came an accounting blunder or accounting cost that lost as much or more.

Of all the systems presented, it can be reasonably argued that a simple financial system that offered month end reporting to the CEO is the system needed the most and is certainly a system that can travel into every industry.

Even if one has the most up to date software, one is vulnerable to the liabilities of whoever is using the system, whereas the TFS™ (Total Financial System) is designed to elevate this worry.

And it’s not just in South Africa, and whilst I’ll not get into great detail about the need to depart from my UK accountants other than to say in 2016, they made a £4000 error, and then tried to charge me for fixing their mistake; and in 2017, they were about to make the same error and were likely to charged me once more, so I quit.

However, there was another reason, and that was my wish to see how easy or hard it was to create and pay corporate tax and VAT.

However, what I did not know is that the HMRC government systems used to pay tax are not fit for purpose.

We shall return to this point after the following solutions to the points just raised.

Is Unique or performs better than competitors because…

1. The TFS™ (Total Financial System) is designed to be unique; as it, like every other S-World software system, is a part of one system, it is not various systems added to each other. I know we have head to this point before, related to other systems. But the importance of creating one system and not try to attach many different components together really is infinitely superior, and more so when made for a specific industry niche.

When one goes down, the many software systems linked together route. One can either go ‘CRM’ first like Salesforce, and then add to it financial systems that are not as good as dedicated financial software, and certainly do not provide a simple end user experience. Or one can go ‘Financial’ first and choose a package like Sage, which granted has its own CRM, but such CRMs are light years away from Salesforce.

And of course, as in both the case of Salesforce and Sage, both are created for every industry, so there is a tonne of functions that are of no use and just get in the way.

Further, neither are connected (out the box) to the website of the business, and so the enquiry data has to be copied from the enquiry forms onto the financial record, and every time someone data captures is an opportunity for making a mistake.

It’s taken a long time to create the framework that can avoid all these uses; and once we create the TFS™ as a part of that framework, it will be unique and better than all competitors’ systems.

2. The TFS™ (Total Financial System) is also unique, as within its design is a rather unorthodox and ‘old school’ manner of collating the data from the bank and putting it into the system without fear of data capture error. And whilst this is now designed as a backup for whatever countries can’t access a banking API, it’s a useful backup to have.

3. The TFS™ prevents agent fraud, which is so common it has a name… ‘outside deals,’ which is much harder to do because the enquiry is tracked through the CRM-Nudge Ai from the word go, and a disproportional amount of near end of deal fails will immediate raise red flags, either the agent needs final deal stage specific training and a number of books to read, or there stealing, either way, its useful data.

Key benefits and/or is a Solution to…

1. Solution to “the landmine of accounting so negligent it may as well be criminal.”

The landmine of ‘Accounting so negligent it may as well be criminal’ is solved by the TFS™, which is a system that has been a pivotal part of the Villa Secrets design since the get go in Feb 2011.

It would be very true to trace back the ‘Accounting so negligent it may as well be criminal’ in 2009 and 2010; as the nudge to my choice in 2011, to step back from the frontline of Cape Villas to create a system that eliminated the need for accountants. This point is highlighted in the first business plan created, as seen within an early version on the CRM connected to a financial system.

And from this point on, for over 7 years, we have been developing the systems. And now, with the framework of the CRM- Nudge Ai coming together and when the enquiry data being added directly, it will take but six months to create the financial systems as presented in http://network.villasecrets.com/total-financial-business-marketing-system/tfbms-part1-total-marketing-system; and in so doing, avoid the landmine of reckless accounting in all the ways previously presented.

And like the CRM-Nudge Ai™ and CRM-Nudge CC™, the TFS™ (Total Financial Systems) will be created mobile first and the entire accounting process will be performed on mobile, which has the knock-on effect of making it super simple by design.

2. The solution to the problem of poor accounting software.

When it comes to the software that we struggled with Pastel for 8 years and spent hundreds of thousands of dollars trying to set up; few would argue that it has been created in a way that is deliberately complex, so that the accounting industry knows their clients can’t use the software without the accountant’s assistance.

We did consider QuickBooks, but as (in South Africa) most accountants did not use it, it made little sense for us to use it.

There are now a good number of accounting software products that I’m sure are pretty good, but none of which are integrated.

The best solution is to create one’s own software, maybe at first connected to a system such as Sage via API, but in time built out as a standalone system. At this point, one may feel that an accounting software is typically hard to create. This maybe so for a system that can work for every business type, and so needs tax info from every company type and every country kept up to date, and to comply with each country’s regulations. Then sure, that’s a lot to do.

But when it comes to collecting data from the bank, reconciling the booking made, and making staff and other cost centres; there really is not that much to do, one has already created all the database fields, most of which are created as part of other systems.

Accounting software in terms of the math is very simple indeed. Take the spreadsheet that has been created to present the Scenario 7 forecast, this is infinitely more complex than what we are talking about.

There is a basic rule to programming, if one can do it on a spreadsheet, it’s simple to do in a database. In fact, it’s easier in a database. All one needs are the skills and design to create the CMS pages to display the data in different ways, and no one is denying our CMS creating capabilities. Creating the system, as specified, is simply a case of basic math and CMS skills.

By creating the system ourselves, we can add special alerts and conditions for items like the guest moving scenario described earlier. And of course, as all the data is already in the system from the enquiry process, including the prices and all data that one would need to add to an accounting system, the accounting person has no such data inputs to make; saving time, increasing efficiency, and making the system very hard to manipulate.

The only missing element that one would wish to include is connectivity between the bank and the system. But as we have heard in the 2018 updates, such connections are now being researched.

3. Avoiding the landmine of accounting fraud.

Having already eliminated the accounting staff ability to manipulate the data relating to the client and each deal, as such data is all collected before it gets to admin; the other area where unmonitored admin cheats and could manipulate the data is in the banking. I’m sure there are a number of ways to cheat in this regard; but if one eliminated the data capturing from the bank to the system, then it really cuts down options. And in most cases, as it’s not easy to start to steal, most simply one won’t steal in the first place.

When it comes to connecting one’s bank to one’s system without data capturing in a way that works for every bank, there is only one solution.

Our solution, in this regard, may not be sexy; and to many it will sound outdated. Many will say, there is a better way; but that would be correct in Western countries. But in the rest of the world, in 2017, it’s really the only possible way. And unlike other methods and products that create banking APIs like https://kontomatik.com that charge one Euro per transaction, our method is without cost.

Our initial solution to this, the ‘data capture error’ problem, is that we simply download the latest banking data as a CVC spreadsheet and upload it into our system. As I said, it’s not sexy but it’s simple to do, it’s free; and importantly, in fact, critically for the Villa Secrets network, it works for every bank on the planet. We have already tested viability and there is a small bug, that if two payments are made for the same vendor at the same price on the same day, then a manual correction is required. But this happens very rarely if at all.

This solution not only stops data capture errors, it all but eliminates ways that accounting staff can defraud a company. So, really, it’s 2 solutions for the price of one. Then there is the time saving as well, so three solutions in one.

As previously mentioned, route 1 is now to automate the banking.

4. Solution to the landmine of accounting fraud.

As there is little data capturing except on one-off purchases, and as all individual costs will be neatly presented in specific categories; where any new unexpected payment out is flagged for attention, combined with the bank double checking in the form of the screenshot which must tally with the system, it makes fraud very hard indeed.

More can be done and will be done if we uncover any ways to trick the system. But in general, the TFS™ is a system that is designed to make it almost impossible for the financial controller or anyone else to commit fraud.

HMRC System Errors (UK Gov Tax)

Personally, I do not believe a tenth of the stuff the Russians seem to have recently been blamed for. But if I were Russia and I wanted a way to decrease the UK’s wealth and so destabilise it, one sure way would have been to spy my way into making the systems that collects tax so bad that the losses to HRMC are in the many billions, and the cost to business is as much again.

We are now jumping from The Villa Secrets’ Secret 2017 to Paradigm Shift June 2018 and the document I have made for the attention of Nick Down’s, whose job it was in 2008 to find ways to improve tax income, and David Halpern, head of the Behavioural Insights Team affiliated to the cabinet office.

Angel Theory V1. Paradigm Shift

Book 4. The TBS ™ Total Business Systems

www.angeltheory.org/book4-1/total-business-systems-v1

www.angeltheory.org/paradigm-shift-quick-summary-v1

4 Barriers to entry

A Software, Systems, and Behavioral Science Critique of the UK Corporate Tax & VAT Systems

An S-World TBS™ (Total Business Systems) subset TFS™ (Total Financial Systems) research paper for Angel Theory – Paradigm Shift.

By Nick Ray Ball 1st June 2018

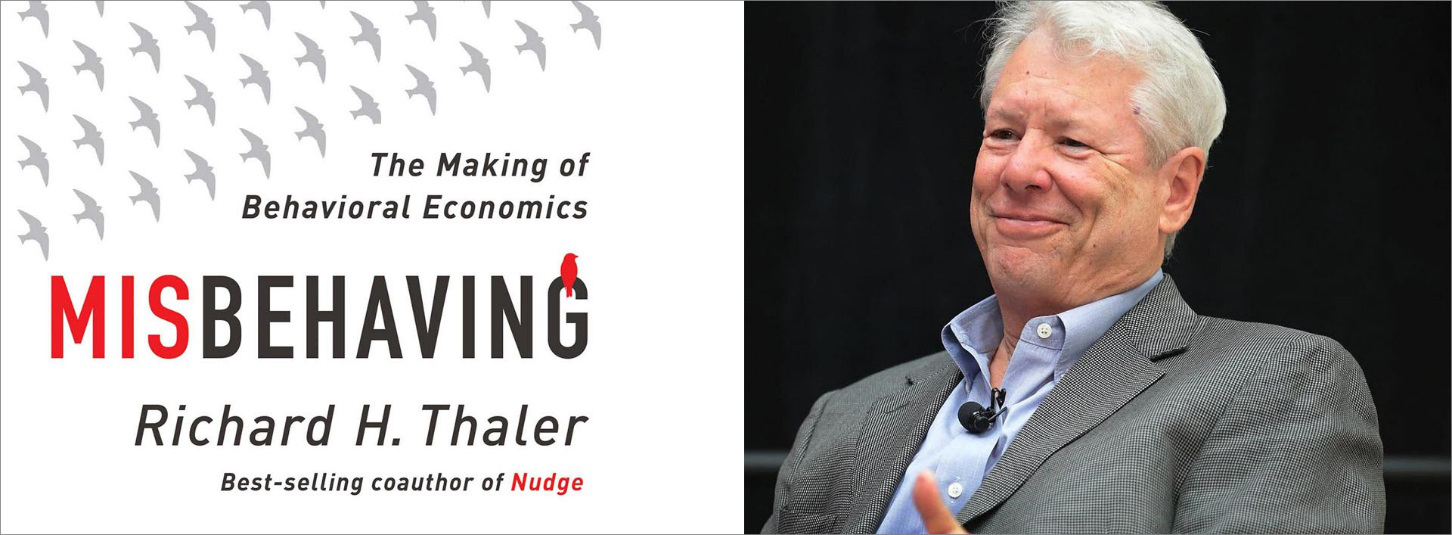

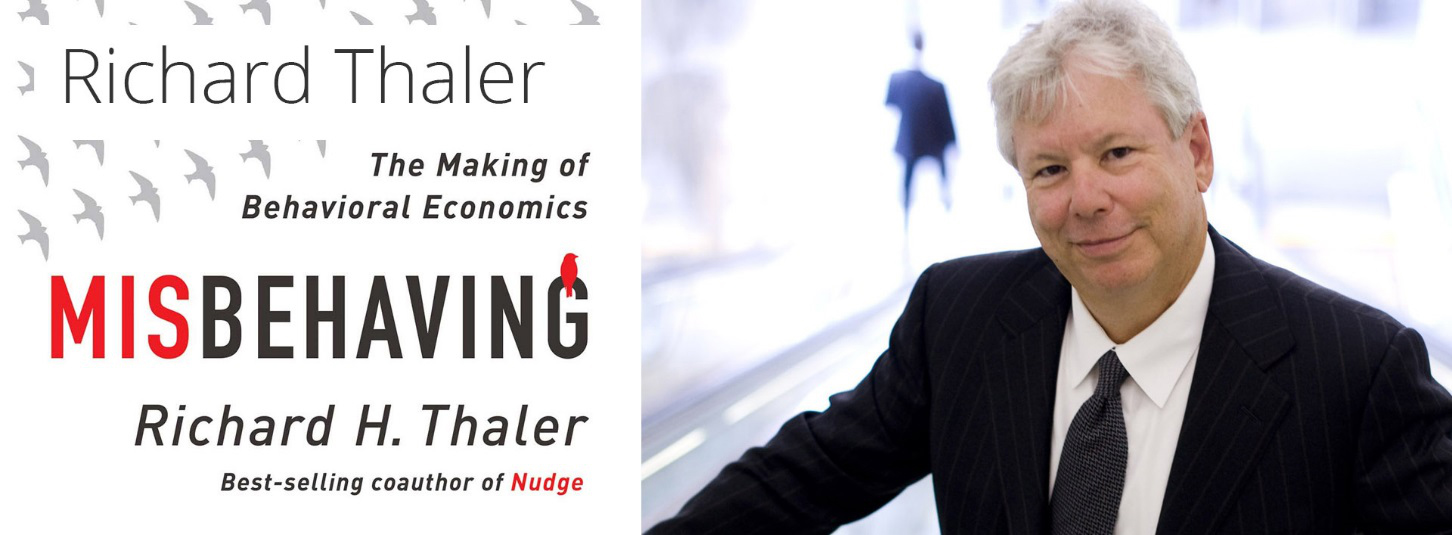

To HMRC, Companies House, David Alpine, Richard Thaler, and Nick Down,

I have found 4 significant barriers to entry that would negate most of the hard work yourselves and BIT have done for the problem, ‘How can we increase tax receipts?’ as described in the penultimate chapter of Richard Thaler’s book, ‘Misbehaving: The Making of Behavioral Economics.’

I shall present the critique and then offer solutions. But first, a summary of the 4 problems; from which if one prefers, one may skip straight to the solutions section.

Barrier to Entry 1

There is a fatal error on the corporation tax form’s auto fill. It only works with Microsoft IE, and it appears that an entire department has been set up just to help people log in, when all that is needed to fix the error is a few days of programming.

Barrier to Entry 2

The same problem is found on the VAT form. But this time, in testing, we found 2 completely contradictory responses coming from the same support team. Responder 1 suggested that one needs to clear their password’s cache (which is incredibly inconvenient as one would need to add every single password for every single site that requires a login); or alternatively, ‘use a different browser.’

After trying 3 different browsers and none working, another call was made. This time the respondent said they have a problem and he would need a new ID, that would be sent in the mail.

That 2 completely different responses were given, it shows a complete breakdown in training and the information given to support staff.

Barrier to Entry 3

From a Mrs Richards whose email exchange which include the following …

If I don’t pay my tax…

“The registrar will not seek delivery of the overdue accounts and no further action will be taken.”

But if I do pay my tax, “a penalty will be issued.’

One does not need to be a behavioral economist to see the above is the opposite of what one should say if one wished to maximise government revenue.

Barrier to Entry 4

In ’Barrier to Entry 4,’ we see the actual tax form is so complex that the support staff can’t help with it, and that there is no online support, help pages, or tutorial videos.

The full account from ‘Barriers to Entry’ 1 to 4 follow.

I will start with the system that, in my opinion, is the biggest barrier to entry; and it certainly is the easiest to fix.

However, please note that as this critique developed, it became evident that the entire system needs to be re-created putting logic, simplicity, and www.behaviouralinsights.co.uk at the core of the system design; from software to support staff systems. We shall find my comments on this at the end of the article.

Before we dive in to the critique, a quick quote from 2017 Nobel prize winner Richard Thaler author of ‘Nudge’ and ‘Misbehaving: The Making of Behavioral Economics.’

From ‘Misbehaving’:

“The meeting with Nick Down was atypical. More often, the minister or some agency head needed to be sold on both the value on behavioral science and the need to experiment. In many of our meetings, I found myself repeating two things so often they became known as ‘Team Mantras.’

1. If you want to encourage someone to do something, make it easy.

This is a lesson I learned from Danny Kahneman, based on the work of Kurt Lewin, a prominent psychologist of the first half of the twentieth century. Lewin described the first step in getting people to change their behaviour as ‘unfreezing.’ One way to unfreeze people is to remove barriers that are preventing them from changing, however subtle those barriers might be.”

Ok, thanks prof, congratulations on the Nobel.

Let’s go. But before we do, note that for speed, I am working from memory. However, I do have hours of video, audio, and emails that will back up everything I say except in barrier 2.

1. Fatal Error in Auto forms on Chrome Browser.

1. I have found a critical error in the online forms for the UK corporate tax collection.

This problem is when using Google Chrome as a browser, using Windows 7 (and as I later found out it also fails on Firefox and Safari when working on an older Mac). So far, it’s fine on IE (Microsoft Internet Explorer), however, I expect the system was programmed using IE and the programmers/engineers did not test other browsers (an amateur mistake if ever there was one).

a. On the sign in page, https://www.tax.service.gov.uk/cato/start-filing/eligibility/select-organisation-type

On this page, if you add the correct User ID, for example, ‘592753295037’ and the correct password; the auto form’s function on HMRC’s servers changes the User ID ‘592753295037’ to your email address. And even if you then add the correct ID back ‘592753295037,’ the auto forms will replace it with your email address every time you click the ‘Sign In’ button.

This is particularly troublesome because to the eye, one does not notice the problem at first. For me, personally, as soon as the system told me ‘Invalid user ID or password. Try again,’ I looked at the username and password and presumed they were correct and tried again, but this time continuing to use the email address that was displayed. And when I could not make it work, I requested a change of password, and started again. Only to be baffled again. This happened three times. And each time I requested a new password, it also gave me a new ID. And each time I added the correct ID and password, the auto forms’ erroneous code would change it to the incorrect user email address. Eventually, I gave up and moved onto another task.

A couple of weeks later, I came back to it. And when I read my notes, I noticed that I had 3 different User IDs. So, I was immediately aware that there was a problem with the User ID part of the website, not a password. But now, I had another problem, as I had requested 3 password changes which created 3 different IDs, it would not give me another. Instead, I needed to contact HMRC and the new ID would be sent by post within 7 days.

A week later, the new ID was delivered. But this time I knew to be very careful on the login page. And this time, I noticed that where my email was in the user ID, it was in fact supposed to be the ID number. So, I added the correct number and clicked ‘log in,’ but again was faced with ‘Invalid user ID or password. Try again. ‘

But this time, I noticed that it had replaced the 12-digit code with my email, and that it did this again and again, a typical auto forms coding error.

So I phoned HMRC and pointed out the problem, and the lady told me I had an auto forms error. I did not point out to her that actually the error was that the HMRC system was incorrectly populating my auto form, but it was obvious to me that this was the case.

Also, the language was a tell, that she knew to tell me it was my auto forms that were at fault. She obviously knew this problem well, then she suggested scrubbing my password’s cache, which was crazy; as if I did, all of the 100 or so passwords that Google has stored for me would all need to be re-entered. When I protested, she suggested I use another browser (which should have been her first suggestion), and I said I can use IE, and she said that would work well.

Again, the language here (which I have on video) suggests that this is a common problem that they have to deal with all the time. And of course, it does not help that she and other call centre staff have seemingly been told that the auto fill’s problem is a client problem. Obviously, somewhere, someone made a solution and told the staff what to say, and that someone had no idea that the problem was theirs to own and would not take long to fix, if only they presented their developers with the error.

Solution to this problem

Prevention

a.i. Let me and my team fix it for you for free.

a.ii. Send your development team this critique and let them deal with it.

Cure

a.iii. Inform all staff of the problem and have them be a little nicer about it, admitting that they are currently having development issues. Like Barclaycard did a few years back, when they launched their new online banking website only to find login problems. I did not mind so much because they owned the problem and were apologetic.

2. Same Problems for VAT but Much More Income Lost.

I shall not labour this point, as the problems are much the same as above. My source for this insight is my father who often struggles with his VAT online filing.

I did not record the incident from yesterday, but I did make notes.

Firstly, my father added the correct ID and Password into the HMRC login https://online.hmrc.gov.uk/vat-file/trader/217390568/return/period/478.

What followed was a 30-minute exchange between him and a customer assistance officer discussing the same problem per point 1; but in this case, it was Firefox on a Mac.

Again, the HMRC assistant suggested that it was an auto forms error on his computer, not understanding that the error was the way the HMRC system populates forms.

HMRC asked my father to clear his password cache; and luckily, I was there to tell him not to. Then, HMRC asked him to swop browsers, so he used Safari and got the same problem.

The representative gave no hint of an apology. HMRC likely does not even realise they are doing anything wrong. They may as well have been ‘Currys PC World,’ trying to get out of giving a refund after selling dodgy high-end laptops that don’t work with Microsoft Office.

This said, it’s not the fault of the HMRC staff, it’s a catastrophic breakdown of reporting within the department.

In the end, I suggested that my father use my PC and IE, and he got in. But then, it got itself stuck by asking for a second phone number to send the 6-digit verification code to. At this point, we went around in circles for a while and gave up.

Conclusion…

Whilst there is a good argument that not many people try to do corporation tax returns themselves, most using accountants; to find that the system is even more unstable for VAT is surely a billion-dollar problem.

When I first started CapeVillas.com in 2002, I was advised not to register for VAT unless I absolutely had to, as it was a cost and a lot of admin. I’d expect a lot of start-ups get the same advice. Given that there are likely a lot of people who should pay VAT that don’t, the barrier to entry (as presented) will be enough in a lot of cases to nudge many to continue the status quo of not paying VAT.

Especially as from a behavioural sciences perspective, the status quo is hard to shake in the first place.

Indeed, there may have been many great initiatives thought up by Richard Thaler, Nick Down, David Alpine, and the www.behaviouralinsights.co.uk team that did not work out as well as expected due to the barriers to entry. You may have nudged some or even a great many to compliance, only to see them fail to pay due to the barriers to entry and lack of support, which returned them back to the status quo bias of not declaring VAT and other taxes.

Update! (1st June 2018)

As an update to the above, my father tried again after a few days, but this time received a totally different response from the support team. This time, when Dad told the support guy his problem, the guy instantly said that he would need to issue Dad a new 12-digit ID number.

Dad informed him of what the previous fellow said just 3 days earlier about clearing his password’s cache. And when Dad refused the suggestion to change to a new browser, and the new guy clearly stated that as Dad’s company was not a corporation, sometimes they just deactivate your login. And that he was 100% sure that no matter what Dad did, he could never get access without a new ID.

He gave Dad the new ID, and he gained access???

This point, that one has two different support officers accessed via the same phoneline and quite possibly in the same office, who have completely different answers is a complete breakdown in logical systems.

And that the IDs sometimes just expire out of the blue is not much of an answer and not necessarily true. It’s more likely that by trying to access the same account on a number of occasions, a system not dissimilar to Hulk Force protection has terminated the ID as it was used so many times without gaining access. Albeit I can’t be sure.

Either way, having two staff give completely opposite advice on something that should be simple is, in my opinion, the nail in the coffin for the current software and support staff.

And further, that it really does seem that there is an entire department of staff dedicated to solving the login problem is absurd. Just fix the problem, it’s easy.

3. Do not encourage clients to move their companies abroad.

And never incentivise them to do so.

Ok, so after two mostly technical points, we will do a pure behavioral science point that I have on email.

The general problem was the timescale that was suggested was not enough to cover the time it would take to receive the various mandatory snail mails, plus the ongoing login problem was still unsolved at that time.

Companies House,

Ref: NUM639173X

Date: 24/03/18 10:03

From: nick@villasecrets.com

Dear Mrs Dawn Richards

Correspondence included:

I will have to close the company and re open a new company in another country, after all my website for http://www.villasecrets.com is not in any way including the UK.

To which she replied

“If you no longer wish to keep the company you can apply for it to be removed from the register by completing a Form DS01 along with the fee of £10, on acceptance of the DS01 the registrar will not seek delivery of the overdue accounts and no further action will be taken.

If however, you wish to keep the limited company you will be required to file the accounts to Companies House were a financial late filing penalty will be issued to you.”

Yours sincerely

Mrs Dawn Richards

Compliance Case Officer

This is, of course, hilarious to any behavioural scientist and could end up being the Behavioral Insights Team’s ‘best example’ of how not to behave. Mrs Richards is making it easy for me to avoid paying tax to the UK, by moving my business abroad, and actually threatening to fine me for staying put???

And from the language,

If I don’t pay my tax…

‘The registrar will not seek delivery of the overdue accounts and no further action will be taken.’

Mrs Richards is presenting what could be used in a legal argument for one to think she is actually saying ‘I do not have to pay any outstanding tax owed as long as I fill in a DS01.’

Which is completely incorrect, and should never nearly be alluded to.

Then hits me with…

But if I do pay my tax, “a penalty will be issued.’

However, as I was reporting a loss due to borrowing for the development of Villa Secrets, Angel Theory, American Butterfly and other projects; there was no motivation for me to avoid tax, I just needed to register the loss.

And in case someone is wondering why I don’t just get an accountant to fill in the form, I needed to know how to pay the tax as a part of the design for our financial systems, the S-World TFS™ ‘Total Financial Systems’ (this chapter). And in addition, my 17 years of experience with accountants has taught me to avoid them.

A quickly thought Solution

It’s very difficult to motivate staff to change in a culture where good service does not see any reward.

Further, it’s hard to motivate staff to make more money for the government departments if no one in the entire organization is financially incentivised, from call centre agents to the CEO (or whatever equivalent position that is).

If this were my job to fix, I would use past data and whatever else we can find to plot total receipts each year and see the curve. Maybe it’s up 2% this year, but in good years can be more. There will be an average and this can be used as a benchmark.

Then, in an arrangement not completely different to the Behavioural Insights Team and number 10, one creates a well financially motivated unit that can pay super manager salaries and incentivise this new unit with as much as 9% of additional income gained (above the curve) to bolster the team; including teams that are dedicated to getting companies all over the world to re-register in the UK.

Then assign one or more percent of the additional revenue made above the curve as profit share per the S-World CRM-CC (Company Controller) between all personnel. So, everyone is motivated to see the UK tax office is making as much money as it always could.

To end, I will quote Richard Thaler again:

“When the stakes are in billions of dollars, small percentage changes add up, as one famous United States senator famously remarked, ‘a billion here and a billion there and soon your talking about real money.’”

4. No tutorials or videos on a highly complex system.

Having mastered the art of navigating the browsers and other barriers to entry for the Corporation Tax online form up to the page ‘Balance Sheet’ (AC42 to AC 81), the form was easy enough.

But to me, the Balance Sheet’ (AC42 to AC 81) does not make logical sense, and the standard staff at HMRC do not understand it either. To get assistance, you need to give the specific points such as AC68 and AC80, and they will call back a few days later.

The page starts of by asking the value of AC42:

‘Intangible Assets – The value of the company’s non-physical assets, for example, patents, trademarks, licences, goodwill (taking account of depreciation).’

This was a bit of a curve ball, as the accountants that did the previous year’s return did not ask me about this. So, either they did not have the same form, they skipped it because they knew no one worried about this, or they were negligent. I have the form they created called CT600 (2008) Version 2 which does not seem to have an option for ‘Intangible Assets,’ and is on reflection, it’s a different form all together. A form that would have taken me about 5 minutes to complete following their example from the year before.

Why have I been guided by HMRC website and staff to the much harder form, I wonder?

Pressing on with the online form for now, it asks the value of for trademarks and intellectual property, this is very difficult to assess. What was the value of American Butterfly in 2015 as a new economic system? Potentially trillions, but it was not complete in 2015 so I just added £1,000,000 for AC42.

The next is AC44 Tangible assets – The value of the company’s physical assets used in the business, for example, machinery, fixtures and fittings, office equipment, vehicles, buildings, land (taking account of depreciation).

So, taking this to include the websites www.capevillas.com, www.villasecrets.com, and www.cape-town-luxury-villas.com; where the last was valued at £180,000, I guessed at another £500,000 for the websites and $4000 for my laptops and cell phones for tangible assets. But again, this was not a factor in my previous years’ return and has nothing to do with tax payments. It actually seems like some bright spark had the idea to add a load of survey questions to the form. This is not making anything easy.

The next step is to allocate the assets into: Land and buildings, Plant and machinery, Fixtures and fittings, Office equipment, Motor vehicles; of which none apply to websites? So, I just added office equipment for the laptop, which was a big error, but there were no ‘other’ option.

Next, AC50 to AC61 Current Assets are all zero.

Next, in AC64 Creditors: amounts falling due after more than one year. Debts you expect to settle after more than one year, for example, bank loans with instalments due after more than a year. I added the £23,468.39 loan I took out that year.

Next, in AC68 Total net assets or (liabilities), £1,979,531.61, it deducts the money owed to the bank from the valuation of intellectual property AC42 and AC44, the ‘for sale’ value of the websites plus the laptops and cell phones.

Next, in ‘AC 79 Called up share capital – The total value of all company shares issued at this date. For example, if you issued 100 shares at £1 each at incorporation, and a further 50 shares at £1 each in this period, your called up share capital for the period would be £150.’ This information I do not have, and again it is not apparent on the previous tax return, I will have to guess at £100.

Next, in AC47 Profit and loss account – Running total of profits, retained by the company and not paid out with dividends. Here, I added the losses made in 2015 which are equal to the bank borrowing -£23,468.39.

I click save and continue, and of course I am timed out….

I re entre the info and after another glitch, I came to the barrier to entry from last time.

Make sure ‘Total net assets or (liabilities)’ (box AC68) for the period you’re filing for matches ‘Total shareholders’ funds’ (box AC80).

So, I have ‘Total net assets or (liabilities)’ (box AC68) = £1,980,532 and ‘Total shareholders’ funds’ (box AC80) = -23368.

Which are obviously miles apart. I have come to this same problem 3 times now, and even with writing everything as I have, it does not help.

To compound the problem, there is no tutorial information anywhere that I can find, and the system is well beyond the scope of any one at the Help Desk for filling in form at 0300 200 3410.

They have a ‘Get help using this service’ form that I filled in and I got a short reply a week later. And they have ‘Get phone support,’ but that is the 0300 200 3410 which does not offer help; and instead, you may make an arrangement for someone to call you 3 to 5 days later.

Let me look at the advice given in the email I received from the form.

From: hmrcsupport@tax.service.gov.uk

Sent: 08 May 2018 11:07

To: Nick Raymond Ball

Subject: RE: HMRC online support request WFYJ-8444-DCSM

Sent: 08 May 2018 11:07

To: Nick Raymond Ball

Subject: RE: HMRC online support request WFYJ-8444-DCSM

Note that the email did not display at all, this is another error. It’s not hard at all to create e-mails that are seen on Microsoft Outlook, every single email newsletter one has ever received is proof of this.

Indeed, someone has already identified this problem, as in the header is a note saying of you can’t see the email, click here to see it online.

This again is quite ridiculous, if millions of small companies across the planet can send out content management generated emails, it’s obviously a simple operation.

Note further relating to ‘Barrier to Entry 1,’ that when clicking the prompt, the email opens in Microsoft IE, overriding my preference setting for Google. This tells us that someone within the development company knows there is a problem with other browsers.

From: hmrcsupport@tax.service.gov.uk

Sent: 14 May 2018 12:42

To: Nick Raymond Ball

Subject: RE: HMRC online support request WFYJ-8444-DCSM

Sent: 14 May 2018 12:42

To: Nick Raymond Ball

Subject: RE: HMRC online support request WFYJ-8444-DCSM

HM Revenue & Customs

Hello Nick

Your enquiry has now been passed to my team to deal with. please also accept my apologies for the delay in replying

If you are completing micro-entity accounts, then Cap[ital and Reserves are entered in Box AC490. This box does need to march AC68.

AC490 will be the total of the Called up share capital (total value of the company shares, which should be a minimum of £1) and the profit and loss account for the period. These figures are basically the company assets which is why they need to be the same as AC68 which also display the company assets

I hope this helps

Kind regards

Jackie

HMRC User Support Team

Unfortunately, this email is not helpful. It mentions Box AC490 which is not on the page. I consider maybe Jackie meant Box AC49, but this box is for 2016 and I am doing 2015.

Maybe Jackie is trying to say that the value of the shares in AC70 (Called up share capital) or AC76 (Revaluation reserve) should be equal to the AC68 Total net assets or (liabilities). But if this was the case, surely Jackie would have mentioned these options more specifically?

Call Back

As well requesting the help by email, I also requested a call back (which was said to be 3 to 5 days, sometimes more). And I know that the call back came, and its message is on the answerphone. And of course… He did not leave his name, and the phone number he gave was general enquires who cannot help with this page.

Ok, so I will instead reply to Jackie by email, and include this entire critique of the system.

This chapter is not over.

Solutions

At the least, one really needs to create a detailed written tutorial webpage and a video of someone following the instructions that clearly explains this page and others, that are so complicated that the general staff at 0300 200 3410 cannot help with.

It’s not that I can’t do this, that’s not really the point. The point is the full-time staff who are paid to help (the first line of defence) do not understand it either. If simple tutorials were made, all staff will be able to help all client’s needs.

Due to the incredibly bad systems, staff are overrun, it takes 3 days for an assistant to contact you. If you remove all the barriers and simplify, then the same staff would likely be 90% less busy.

There are other problems, like fix the browser and email problems. But really one should not only make the tutorials, one needs to remake the entire form, making it super simple that one can do it via their cell phone.

Let’s go back to Richard Thaler’s point that we heard at the beginning.

“If you want to encourage someone to do something, make it easy.”

If the idea of the www.behaviouralinsights.co.uk is to find ways to nudge the UK citizens to do things like pay their tax, the 4 barriers to entry above should be addressed before applying the behavioral economics. I can receive the best worded generic letter that nudges me to pay tax on time, but if it’s not possible to pay tax, the carefully worded nudged letter will have no effect.

Chapter 7. Part 2. TFS Tax Systems

In this concluding section, I seek to demonstrate to 2017 Nobel prize winner Richard Thaler and colleagues some of the advantages of our system, and how it can be used in tandem with behavioural science.

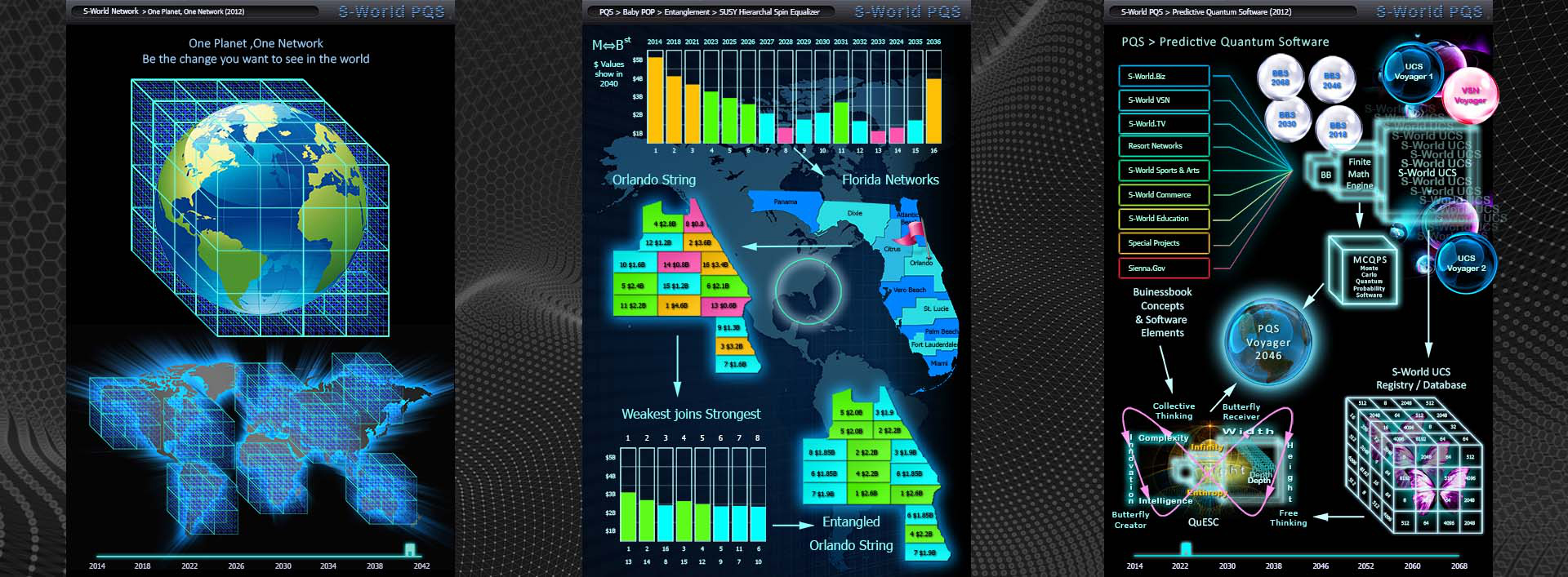

I suggest an adaptation of the S-World and S-Web systems be created for the UK tax office (HMRC). This would will be ‘Sienna.Gov’ software, last discussed in 2013 as part of ‘The PQS.’

Which for all intents and purposes was the original version of Paradigm Shift Book 1. M-Systems.

Before we see some ideas and solutions, a quick overview of why we need to do this in the first place, via an edit of the full article seen above.

To HMRC, Companies House, David Alpine, Richard Thaler and Nick Down.

I have found 4 significant barriers to entry that would negate most of the hard work yourselves and BIT have done for the problem, ‘How can we increase tax receipts?’ as described in the penultimate chapter of Richard Thaler’s book, ‘Misbehaving: The Making of Behavioral Economics.’

Richard Thaler is seen below in the movie ‘The Big Short: Inside the Doomsday Machine’ by Michael Lewis.

I shall present the critique and then offer solutions. But first, a summary of the 4 problems.

Barrier to Entry 1

There is a fatal error on the corporation tax form’s auto fill. It only works with Microsoft IE, and it appears that an entire department has been set up just to help people log in, when all that is needed to fix the error is a few days of programming.

Barrier to Entry 2

The same problem is found of the VAT form. But this time, in testing, we found 2 completely contradictory responses coming from the same support team. Responder 1 suggested that one need to clear their password’s cache which is incredibly inconvenient; or alternatively, ‘use a different browser.’

After trying 3 different browsers and none working, another call was made. This time the respondent said they have a problem and he would ned a new ID, that would be sent in the mail.

That 2 completely different responses are given, it shows a complete breakdown in training and the information given to support staff. And again, it seems that there is an entire department dedicated to logging in, simply due to errors that would literally take a few days to fix.

Barrier to Entry 3

From a Mrs Richards whose email exchange which include the following …

If I don’t pay my tax…

“The registrar will not seek delivery of the overdue accounts and no further action will be taken.”

But if I do pay my tax, “a penalty will be issued.’

One does not need to be a behavioral economist to see the above is the opposite of what one should say if one wished to maximise government revenue.

Barrier to Entry 4

And in ’Barrier to Entry 4,’ we see the actual tax form is so complex that the support staff can’t help with it, and that there is no online support, help pages, or tutorial videos.

The TFS Solution

Whilst I will fly through the solution, please don’t confuse guarded exuberance for flippancy; there would be a lot more to a complete spec, I have only created an outline, which will be further developed as a full chapter in ‘Paradigm Shift’ Book 4. The TBS™ Total Business Systems, somewhere down the road.

The hardest part is making the new website and software work with the old website and legacy systems; a lot of developers have trouble with this, but once you know what you’re doing, it’s just more of the same. I expect there will be many accounting companies that are used to the old system and would not wish to change. As mentioned, fortunately, this is not rocket science and we have been working on similar functionality to this; making data from thousands of odd properties from this 2002 website www.capevillas.com synchronize with this website www.villasecrets.com. Once the synchronisation is done, it matters little if you have 1000 different units or 50 million, you will need bigger servers to handle the data. But that’s about all, from a programming perspective, it makes no difference; 1000 or 50 million, it’s still the same code, just used more times.

Once the connection is created and the old legacy system entries are synchronised with the new web and software framework (which we call ‘S-Web’), we can get to the task of creating a super simple and uniquely logical set of tax collection options for the new online tax experience.

Much of the web framework can come from systems already developed for S-World and S-Web, but the equally important ‘uniquely logical content’ would come from www.behaviouralinsights.co.uk/our-people/staff who would assist in careful planning, careful testing, careful analyzation of test data to create a near perfect or perfect solution.

The planning is from the default menu options, to the user flow, to the quick tap options, to the tutorials, to the monitoring, and improved productivity and utility of all personnel.

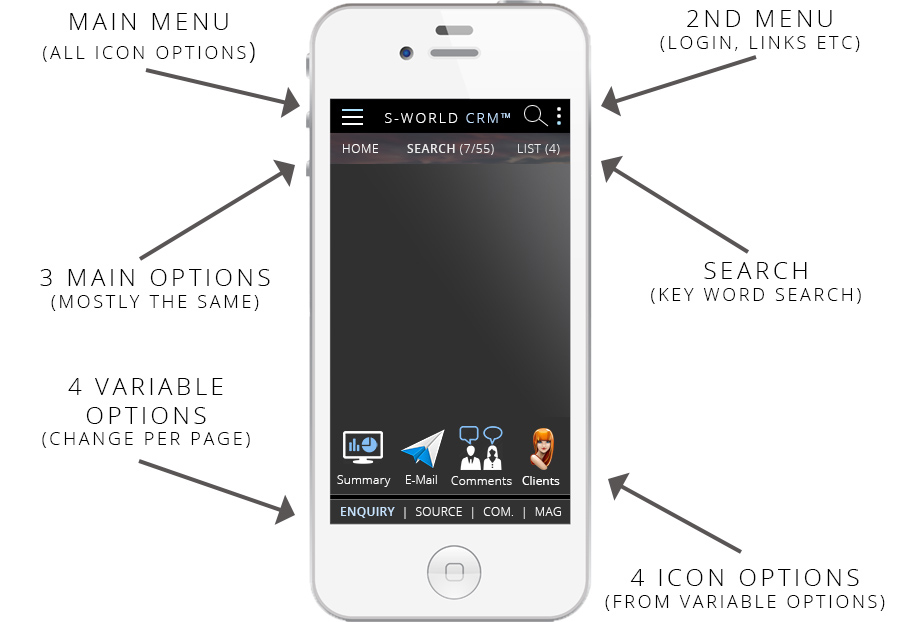

Of course, nowadays, everyone is mobile and app mad. So, the solution must work on mobile, and the only way to do that efficiently is to work Mobile First, with the objective of making the completion of VAT or Corporation Tax (or any other tax) so simple that a 7-year-old child could do it

I’m not saying, at this stage, that we will literally be able to make it so a 7-year-old child could complete the Tax form. However, if we aim for years 7 and above and we end up making it for 10- year-olds, then it’s a win for most adults and certainly an improvement on the status quo.

So, we need to work Mobile First. Why? Because it’s easy to create a desktop version of a mobile app, but very hard to create a good mobile version of a desktop system.

We will start with the S-Web mobile navigation with the basic ‘ default options’ of the app/website.

Let’s here again from 2017 Nobel winner Professor Richard Thaler. But this time, from his New Your Times Best Seller, ‘Nudge: Improving Decisions About Health, Wealth, and Happiness,’ co-authored by Cass Sunstein.

Nudge:

Improving Decisions About Health, Wealth, and Happiness

“The ‘status quo bias’ is a fancy name for inertia. For a host of reasons, people have a strong tendency to go along with the status quo or default option.

When you get a new cell phone for example, you have a series of choices to make. The fancier the phone, the more of these choices you face; from the background to the ring sound, to the number of times the phone rings before the caller is sent a voicemail. The manufacturer has picked one option as the default for each of these choices. Research shows that whatever the default options are, most people stick with them, even when the stakes are much higher than just choosing the noise your phone makes when it rings.

Two important lessons can be drawn from this research:

1. Never underestimate the power of inertia.

2. That power can be harnessed.

If private companies or public officials think that one policy produces better outcomes, they can greatly influence the outcome by choosing it as the default. As we will show, setting default options and other similar seemingly trivial menu changing strategies can have huge effect on outcomes; from increasing savings to improving healthcare, to providing organs for lifesaving transplant operations. The effects of well-chosen default options provide just one illustration of ‘nudges.’

So, after creating the framework, we start a new application. And from the very beginning, we should work hand in hand with behavioural scientists to choose the default menu options.

In the prototype design, I have accounted for 48 different mobile usage ‘quick tap options,’ but we should not need nearly as many. The S-Web mock up we see further down the page is designed to make many different systems work as one, mostly guided by the Ai. And it would not be incorrect to say that every function the Ai does should be done so only after the behavioural sciences unit have approved the action/flow.

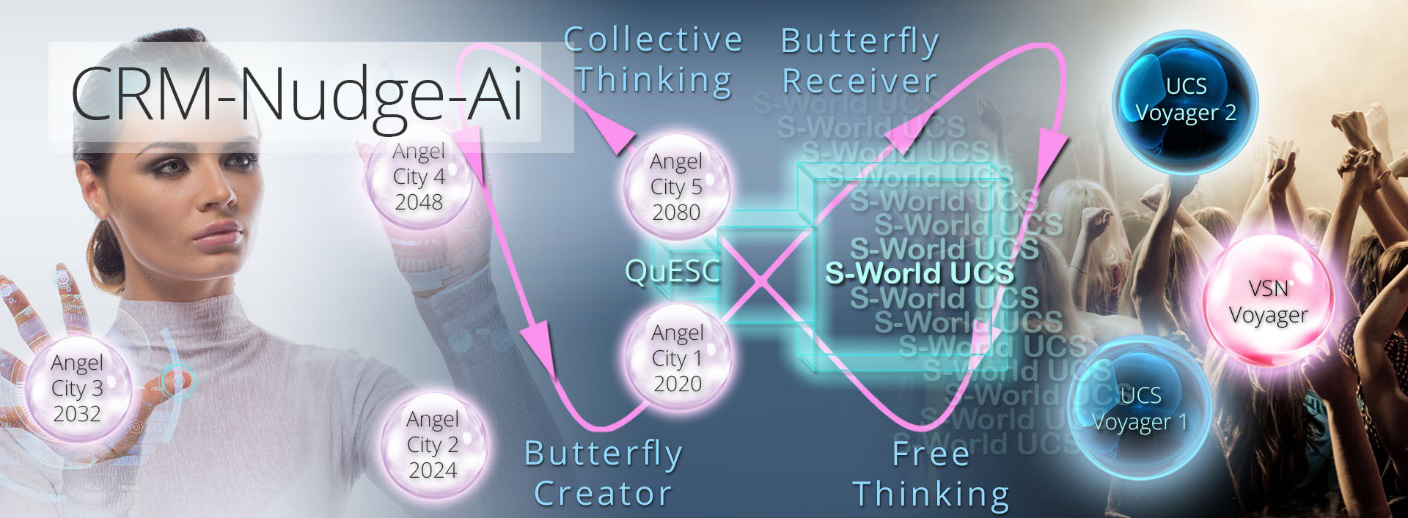

The S-World CRM-Nudge-Ai

Note that only recently has the word ‘Nudge’ been inserted into this system’s name, and it will only remain if Thaler and Cass have approved its usage.

For the full article, go to, Network.villasecrets.com/the-secret/ch6/crm-nudge-ai.

What follows is the section on the mobile navigation options.

The Villa Secrets’ Secret

Chapter 5. S-World CRM-Nudge Ai™

Chapter 5d. Menus and Controls

http://network.villasecrets.com/the-secret/ch6/crm-nudge-ai

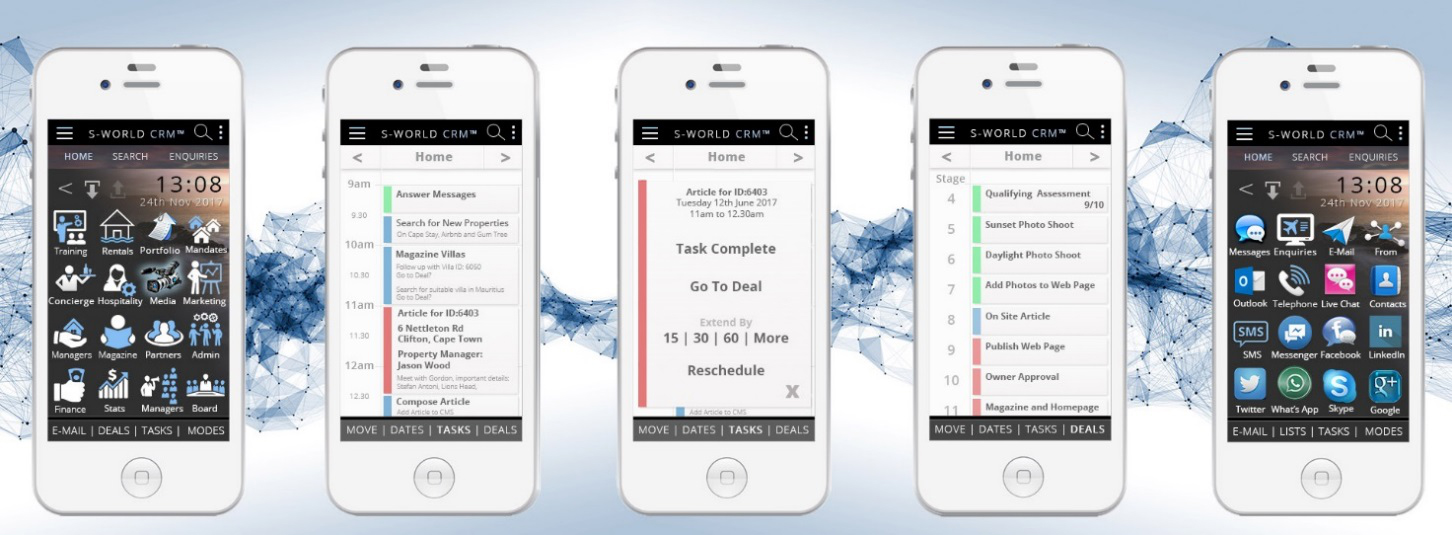

At the top left on the image below, we have a main menu (the 3 stripes) which will link to many page options. On the right, a second menu (3 dots) for mandatory tasks such as logging in and links to other systems or website pages. In addition is a key word search.

However, the objective is to make the system without need for the main menu or search, the functionality of a desk top application with the sort of ease of use you would find in a mobile game.

To create this functionality and avoid the need for having to scroll the main menu, we create a (on page) navigation system. Starting with the ‘3 main options,’ these options will be specific to the user type; and for vacation rentals, it is ‘Home | Search | List.’

To complement the 3 main (top navigation) options, comes the bottom navigation stripe, which changes for different pages. In this example, the user has the option to check the ‘enquiry details,’ ‘the source of property’ (system/bespoke), ‘to display/adjust commission,’ and the user’s ‘My Magazine’ options.

In this example, the user has clicked ‘Enquiry’ and this creates 4 new icons: ‘a general summary,’ ‘the email,’ ‘new comments,’ and ‘client’s client’ options. If one now clicks the clients option, three sub options would be displayed in place of the other 3 icons. All told, creating 48 different ‘quick tap’ options available for each individual page.

End of Extract

The cleverness is not in the amount of quick tap options. The cleverness is how the Behavioural Insights Team will allocate the options, in essence, creating a ‘default’ system that can be navigated with ease.

However, before we get to the menu options, first prize is making a simple system that works almost exclusively on screen; one should not need to use any navigation other than on screen prompts, and the quick tap options are there mostly for tutorials and options that only the support ream would use, which would not be seen by the public.

Quick ideas to begin the conversation…

A proper spec would require meetings and weeks of prep. For now, these are just starter ideas, many or even most of which would not make the final version.

Page 1, on screen should simply ask which type of tax one wishes to pay; Corporate Tax, VAT, Income Tax, and others.

Next the login page, which is currently the biggest cause of problems, is actually very simple to get right; cross browser access is a very basic part of web and app design, especially if you have your own web framework.

Next, we should add different options based on the following…

1. One must create all system as one; the website, the app, the CRM used by the support, the oversight reporting for management and anything else one can possibly think of. All need to be the same system, these are quick and extreme laws of limiting returns if you use a handful of different systems created by different programmers or companies.

2. One needs to make different versions of the website and software for different user types. Consider for example, ‘Salesforce’s’ software, a CRM program. This software has been created to work with every business type there is, and because there is a lot of clutter, and there is no specialist product made for any specific industry.

The S-World solution to this is to make hundreds of different types of the same CRM, Software & Websites for different industries and then different niches within each industry.

By working in this way, we can throw away most of the clutter and make a clear and instinctive path to guide the user through the paying tax experience.

And of course, it’s really up to the Behavioural Insights Team to choose both the different sub groups and creating the ‘clear and instinctive path.’

It may sound like a lot of work, but really, it’s not. One starts out with a version with every possible option (all the options of the current system). And then one creates different versions of the same system but does not include any options that are not relevant. And of course, one can make different versions for the same users and see which is most effective after analysing the results.

In ‘Barriers to Entry Point 4,’ we saw how the options are so complex that the support staff don’t even understand what to do. And they have to get someone to call you back in about 5 days; who does not even leave a name or any way for them to be contacted, then save the basic login support phone number, who are only trained to help with logging in. An entire division of staff employed to solve the problem of the login complaints, all because of the login problems as presented in Barriers to Entry 1 and 2. Which, if we remember, are not more than a few days’ work to fix, if it even takes a day.

Making the systems simple and providing high-end tutorials, written and on video, added to the fixing of the login problems, would reduce the need for the ‘login support team’ by as much as 90%.

All of whom can by using the S-World UCS™ tutorials to advance their position to form completion support, reducing that five-day wait to immediate assistance.

Not to get to focused on S-World UCS™, as when you go down that rabbit hole, one could end up writing 100 pages just in its basics. There is a short summary available here: www.angeltheory.org/book7/s-world-ucs-simulator-v1. However, for this exercise, we only need to focus on the S-World Company Controller and S-World UCS™ Hawthorne Effect System.

I will just touch on the basics. Firstly, the S-World Company Controller or ‘S-World CRM CC.’

The system can be adapted to give tutorial or exam tasks to personnel when they are not dealing with clients. And if they are completely busy all of the time, then time should be set aside for them to learn; plus of course those who wish to move forward in their careers, they can always look at the tutorials at home, on the tube or other…

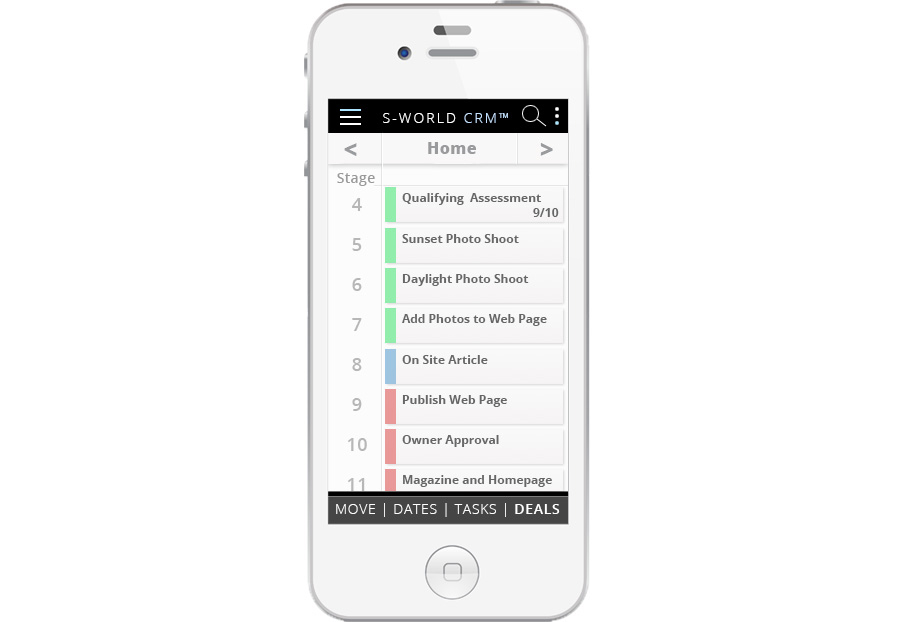

When they are dealing with clients, a deal stage can be brought up with a step by step walk through all the parts of the process, keeping an exact record of how far the users have got. The below example is for recruiting mandates, but the same step by step logic can apply to each and every tax client, and the different steps… 1. Login > 2. Form > 3. Other > 4. Etc.

Next, we move into S-World UCS™ Hawthorne Effect System, which is based on an idea gained from behavioural scientist David Hoffeld’s book ‘The Science of Selling: Proven Strategies to Make Your Pitch, Influence Decisions, and Close the Deal.’

In which Hoffeld presents the ‘Hawthorne Effect,’ which in a nutshell shows that personnel work harder when they are being monitored.

As the task planner assigns pages of tutorials when the call centre is not busy and created exams based on system knowledge; at the same time, each deal made (each tax client seen through the journey to pay their tax) can be easily assessed, one can easily assign a point score to each task which can be seen on a scoreboard that starts from zero each day, which creates a winner and a loser each and every day.

In S-World and in particular for S-World Grand Networks, at least half of all the personnel’s remuneration is assigned as profit share that will be paid out to winners. So, each day is a new day to win the day (by being on top of the scoreboard). And profit share is paid to those who win, and those that lose would make less than half of another staff member in the same pay grade.

I have fleetingly mentioned profit share before. But I can see that this, being a big decision, is not likely to be made any time soon. However, we can incentivise in other ways. The most obvious being promotion from junior login support to senior form support and other positions.

Another idea is simply to get a 50-inch TV in the office that only shows ‘the scoreboard.’

Are you seeing it yet? Of course, by applying the above, we create a Hawthorne Effect as everyone will (in fact) be monitored by the Ai and all their peers every second of every day.

As mentioned, persistent winners can be promoted, and persistent failures can practice in their own time to get up to speed or can be retired.

Getting back to the different systems for different industries, in addition to this, I would suggest having different systems for different sizes of business.

Survey data?

As far as I can see, someone thought it would be a clever idea to use the tax form filing process to add a bunch of survey questions that are not necessary and are not covered in the tax forms that accountants use.

This extra data should be collected at different times, as we saw in ‘Barrier To Entry 4.’ The form now asks people to estimate the value of one’s trademarks and intellectual property, which is useful data. But these questions were not on the form my previous accountants submitted in 2015, and are not relevant to how much tax one pays. Further, it’s very hard to estimate the value of trademarks, patents, and intellectual property. Route one is get the client to the end of the form and receive the tax as quickly and as simply as possible, all data asked for that is not needed should to be stripped away. There are other ways to incentivise tax payers to assess the value of their businesses.

The Villa Secrets’ Secret – Relevant Chapters

For more details on the core systems, which as shown can be used as the framework for many industries and studies, see the following Network.villasecrets.com chapters:

1. Network.villasecrets.com/the-secret/ch1/s-web-cms-framework-step-6-our-solution

6. Network.villasecrets.com/the-secret/ch6/crm-nudge-ai

7. Network.villasecrets.com/the-secret/ch7/tfs-total-financial-system

9. Network.villasecrets.com/the-secret/ch9/crm-cc-the-company-controller

10. Network.villasecrets.com/the-secret/ch10/s-world-ucs-tutorial-and-incentivization-game

And as a farewell note, a quick graphic from last year which shows my ambition to make the S-World UCS simulation software played as a game to better make the systems for the NHS.

For more information on S-World UCS, arguably the most significant S-World system, see the following:

www.AngelTheory.org/book7/s-world-ucs-simulator-v1 (2018)

www.AngelTheory.org/book/1-3/the-s-world-ucs-m-systems (2017) (requires login)

Network.villasecrets.com/the-secret/ch10/s-world-ucs-tutorial-and-incentivization-game (2017)

Americanbutterfly.org/pt1/the-theory-of-every-business/ch8-s-world-universal-colonization-simulator (2012)

A far more in depth view will be presented in Angel Theory Book 7. And note that Books 2. Part 2 ‘A More Creative Capitalism’ and Book 3. The GDP Game are in themselves S-World UCS Simulations.